Income Tax, Investment, Car Insurance: 3 New Changes That Kick In From April 1

If you are a taxpayer in India, then you ought to read through this carefully.

How often do you upload pictures of your holidays in foreign locales or of a new car on social media sites? Or do you, like many others, like to hold onto your shares in their trading forms? If yes, then please be aware of some changes that the tax department is implementing.

Here are some changes that every Indian taxpayer must be aware of:

1. Income tax

‘Project Insight’, the brainchild of the IT department, is a tax tracker expected to allow tax officials to develop comprehensive, 360-degree profiles of Indian taxpayers. Through this Project, the IT-dept. can gather information from various sources including accounts on social media platforms such as Twitter, Facebook, and Instagram.

In doing this, India joins countries such as Belgium, Canada and Australia that are already using big data to detect tax evasion.

Built over a span of seven years, this tracker cost about Rs 1000 crores. The tracker uses various parameters to track individual taxpayers.

According to a Twitter post published by the New Indian Express, the data gathered includes taxpayers’ addresses, signatures and I-T return profiles. It is understood that there will also be a segment named ‘business intelligence’ to identify tax evaders. The Geographic Information system, another feature of the tracker, will help the I-T department zero in on a particular area if it requires more focused action—classification being income, profits and capital gains.

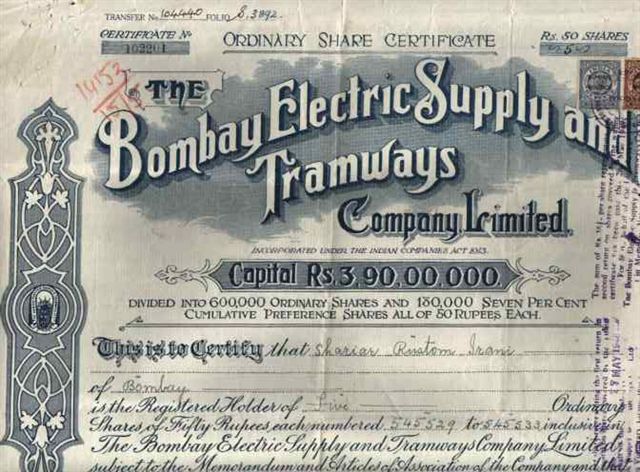

2. Securities and Exchange Board of India (SEBI)

I know of many of my father’s friends who still hold on to the physical copy of the shares they own. If you are one of them or know someone who does, then ensure that you urge them to open a demat account to enable them to transfer the title of the shares either by way of inheritance or succession.

According to a new rule being implemented by SEBI, shares in their trading forms must be converted to a demat account.

While SEBI is not prohibiting the investor from holding the shares in physical form, you will need to open a demat account only in case of transferring the title.

Remember that if you have the physical shares of companies that are not active or trading, then you can’t convert them to the demat format.

What is the demat format?

To reduce the cumbersome paperwork that equity trading requires, SEBI has, in an attempt to keep the entire experience easy and streamlined, introduced the demat account. While trading online, demat account is used to hold shares and securities in dematerialised/electronic format. Under dematerialisation, your share certificates are converted from physical form to electronic form in order to increase their accessibility.

To do so, one will have to create a demat account. You are required to provide know-your-customer (KYC) documents such as your PAN and bank details. Post this, you have to convert the physical shares certificate to demat and then submit a dematerialisation request form (DRF) for up to four share certificates if they are of the same company.

Once you have completed the process, you will be notified via a message. When your share certificates get accepted, your units will automatically get reflected in your demat account.

Depending on how you choose to open your demat account, an annual charge is levied, which may range between Rs 200 to Rs 850. To convert physical shares to demat form, it can cost around Rs 150-400 per certificate.

3. IRDAI Insurance

According to a report published by The Hindu Business Line, Yegnapriya Bharathi, Chief General Manager (Non-Life), Insurance Regulatory and Development Authority of India (IRDAI), said in a circular that the premium rates notified on March 28, 2018 for the year 2018-19 would continue to be in force in the financial year 2019-20 till further notice.

The premium rates of the mandatory third-party insurance are notified by the insurance regulator every year in the last week of March.

The new rates go into force from April 1. However, for the very first time in the recent past, the regulator has allowed the old rates to continue for the new financial year as well.

This move comes as a surprise and relief for all consumers who were anticipating an upward revision to the rates. The order further stated that “Insurers shall continue to charge the rates currently being charged for Motor Third-Party Liability Insurance Cover from 1st April 2019 onwards until further orders.”

Here’s hoping these changes prove to be beneficial to us taxpayers.

(Edited By Saiqua Sultan)

You May Also Like: Big Changes Made to Vehicular Insurance Policy: Here’s What You Need to Know

Like this story? Or have something to share?

Write to us: [email protected]

Connect with us on Facebook and Twitter.

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let’s ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167