NEFT, RTGS, IMPS or Mobile Wallet: What To Use For Instant Online Money Transfer?

Post the 2016 demonetisation in India, a majority of transactions have started happening online.

One of the places my grandfather loved visiting was the bank. It was a weekly ritual, which he would not miss for anything. Armed with his passbook and the chequebook, he would march into the bank.

Gone are those days! Today, you can download your bank statement, make transfers, receive money, and do just about anything that required you to visit a bank at the click of a button.

Post the 2016 demonetisation in India, a majority of transactions have started happening online. Here’s a look at how you can make payments:

1. National Electronic Fund Transfer (NEFT)

The National Electronic Fund Transfer is perhaps one of the most common ways of transferring money online from one bank account to another. In this method, there is no cap on the amount of money that can be transferred. However, individual banks may have set their own limits. Also, do remember that each transfer cannot exceed Rs 50,000.

To initiate a NEFT transfer, you must have the bank IFSC code, along with details such as bank account number, bank branch, and account holder name, among other details.

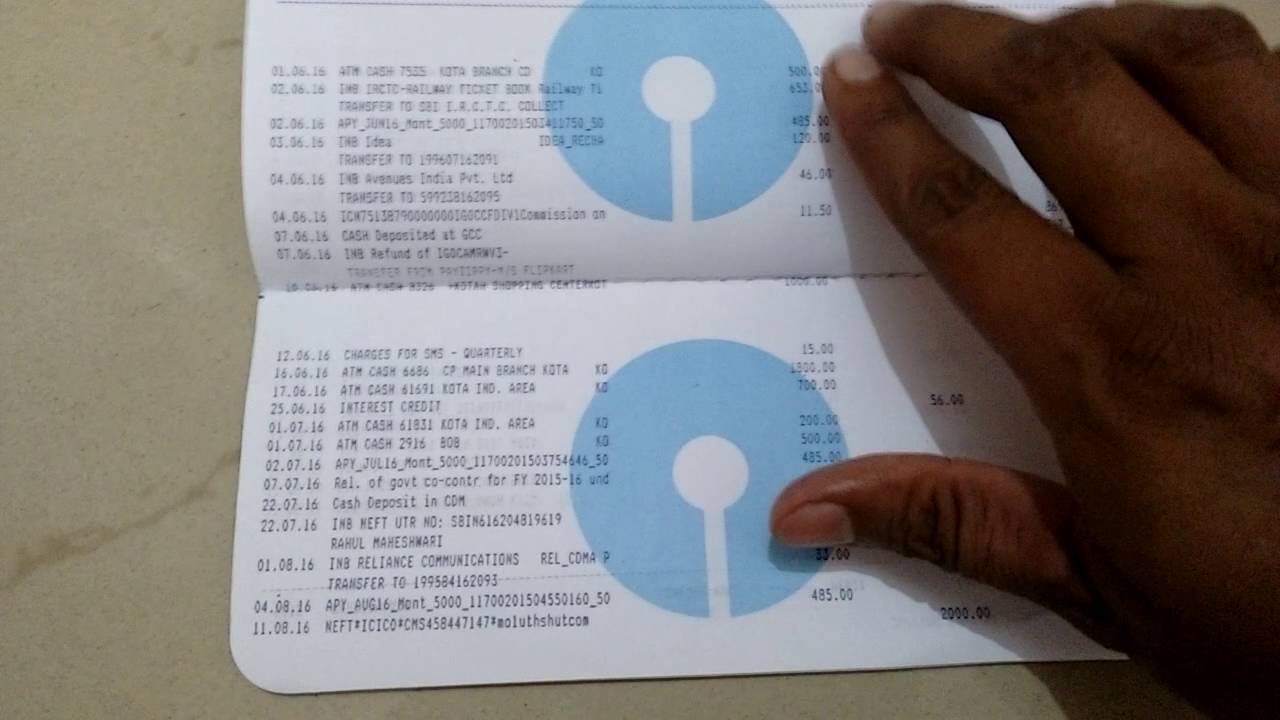

Photo Source: Moneycontrol

You can make a transfer with this method between 9 am and 7 pm on weekdays, and between 9 am and 1 pm on Saturdays.

Some of the benefits of this method are:

• Safe and secure

• Economical

• Reliable and error-free

• Organised and batch-wide settlement

• Paperless

2. Real Time Gross Settlement (RTGS)

This fund transfer method ensures that the money is sent in ‘real time’ without any delay. The minimum amount for this transaction is Rs 2 lakh, and there is no cap on the maximum amount that can be transferred.

The transfer happens on a real-time basis throughout the RTGS business hours, which are 9 am to 4.30 pm on weekdays, and 9 am to 2 pm on Saturdays. It takes approximately thirty minutes for the money to be credited into the account of the beneficiary.

Some of the benefits of this method are:

• Real-time online fund transfer

• Used for high value transactions

• Safe and secure

• Reliable and backed by RBI

• Immediate clearing

• Funds credited on a one-on-one basis

• Transactions executed on an individual and gross basis

3. Immediate Payment Service (IMPS)

One of the advantages of using this method to transfer funds is that it is available round the clock, 365 days a year (even on Sundays and bank holidays). IMPS is a real-time electronic fund transfer method through which money is credited immediately to the beneficiary’s account.

With this method, inter-bank transfers can be initiated through multiple channels such as mobile banking, internet banking, SMS, ATMs, etc.

Because of the quick manner through which money is credited, this is a preferred manner of transferring funds. Do note that banks may levy minor charges for the transaction.

Some of the benefits of this method are:

• Safe and secure

• Ease of transferring funds

• Fastest method of transferring funds

• The recipient gets the amount credited instantly without any delay.

• People do not need to share their bank details, especially, their account numbers for the transfer of funds in this platform. Money can be sent to anyone, simply with their cell phone number.

• The service is available throughout the year, 24×7.

4. Mobile wallets

As the name suggests, mobile wallets are an e-version of the physical wallet you carry around.

A mobile wallet can be used instead of debit cards, credit cards or money, and a customer can make the payment by simply tapping their smartphone or tablet.

Photo Source: Pixaby

There are various mobile wallets available in the different app stores on our smartphones which make it convenient for the user.

Some of the benefits of this method are:

• Cashless transactions at the tap of a button

• Secure and safe

• Convenient

• Fast and streamlined payments

While each of these services makes it convenient for the customer to transfer money and make purchases online, remember to exercise caution while using them. Always crosscheck the account details and amount entered before clicking on any button.

(Edited by Shruti Singhal)

Like this story? Or have something to share?

Write to us: [email protected]

Connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let’s ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167