How Much Tax Should Indian Students Pay For Their Higher Education?

18% GST on auxiliary services availed by higher education institutions could harm India’s demographic dividend.

Social and economic progress in any developing nation is based on its ability to leverage human capital. In the past few years, a lot of the public discourse has revolved around the distinct demographic dividend that India possesses.

As per data from a 2015 sample registration survey of India (SRS) statistical report, approximately 64% of India’s total population lie between the ages of 15 and 59 in 2015.

Of greater significance is the fact that nearly 28% of the population consists of children between the ages of 0-14, making up the future demographic dividend.

Observers contend that this dividend will only begin to bear fruit if the requisite policies and structural mechanisms are put in place.

With over one million young people entering the workforce each month, this could either hamper or improve India’s growth prospects.

Among other factors, better prospects for skill development is a crucial component of leveraging the demographic dividend.

In India, there exists a glaring gap in what students are taught versus industry requirements. This skill gap is why a significant section of our population remains unemployable or unemployed.

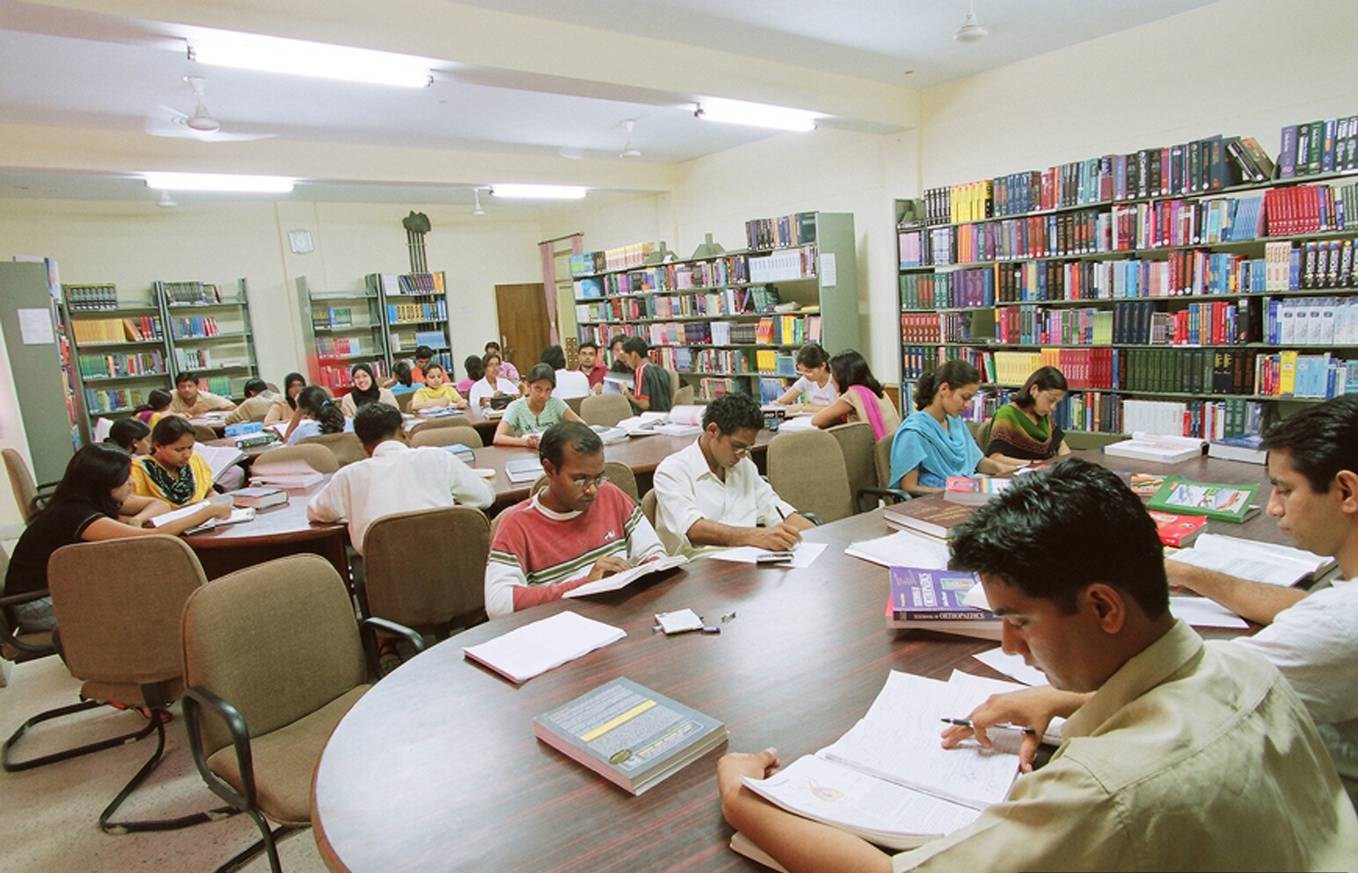

In this context, access to quality higher education for a vast section of the population is critical.

Quality is definitely an issue that policymakers need to contend with on a war-footing, but what if higher education becomes unaffordable for vast segments of our populace?

This is what certain educationists fear after news surfaced that from July 1, 2017, onwards, auxiliary services like hostels, catering, security, transportation, and even admission related services availed by institutions of higher education (both public and private) would attract a goods and service tax (GST) of 18%.

It is well known that many institutions of higher learning source these services from third parties since their focus primarily revolves around imparting education.

Many educationists argue that an 18% GST will only compel such academic institutions to pass on the burden of that additional tax to their students.

“As institutions do not have any GST on income to adjust its input tax credit, the increased cost is ultimately borne by the students,” says a recent media campaign run by Career360, an education portal.

The Education Promotion Society of India, a not-for-profit organization which represents over 300 private universities and 3,000 colleges, petitioned the government to scrap GST for higher education institutions earlier this month.

“Since these services are currently paid by users directly to vendors, GST levy will create a financial burden on them and also lead to an escalation of the cost of higher education,” said EPSI.

“HEIs (higher education institutions) will be forced to stop outsourcing and do it in-house. The management of universities and colleges will unnecessarily be bogged down in managing these services which do not come into their core competencies viz. higher education,” it added.

T.V. Mohandas Pai, the chairman of Manipal Global Education, argued that the government must maintain its position that it will not drag the education and health sector into the tax-net.

“It is high time that the government realise that educational institutions, be it schools or HEIs come under the same social sector and is not a business. When schools were considered and exempted, the government had to give the same consideration to HEIs as well, which would have avoided such a situation,” he said to the Deccan Chronicle. This is precisely the gist of the problem.

If the government wants educational institutions to function as ‘not for profit’ endeavours, then this tax becomes an unnecessary burden. On the flip side, critics argue that many private institutions anyway charge exorbitant fees, and they need to be taxed.

But why should all institutions of higher learning pay for the transgressions of a certain few?

For these institutions, the services provided to its students, faculty and staff were earlier exempt from any sort of service tax. That changed in July 2014 when the government restricted this exemption to six categories, namely transportation of students and faculty, catering, security, house-keeping, cleaning services and admission-related concerns or conduct of examinations.

HEIs are no longer exempt. Thankfully, primary and higher secondary schools continue to enjoy some of these exemptions.

As per the notification issued earlier this year: “Provided that nothing contained in clause (b) of this entry shall apply to an educational institution other than an institution providing services by way of pre-school education and education up to higher secondary school or equivalent.”

In other words, all institutions of higher education are now under the tax net.

Read also: GST Is Down but Prices Unchanged? Govt to Step in After Outrage

“And the result of this change is burdening the student. It is to pursue higher education that students go out, stay in hostels, eat at a mess, travel by bus. And all these are now charged at 18 percent GST if such services are from outsourced companies,” said Peri Maheshwar, chairman and CEO of Career360, in a recent column on Firstpost.

Slapping 18% GST on higher education only creates more hurdles for young Indians seeking to access quality higher education, thus affecting India’s ability to reap its demographic dividend. The GST Council could consider re-examining the issue for the benefit of its young populace.

Like this story? Or have something to share? Write to us: [email protected], or connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let’s ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

- 97

- 121

- 89

- 167