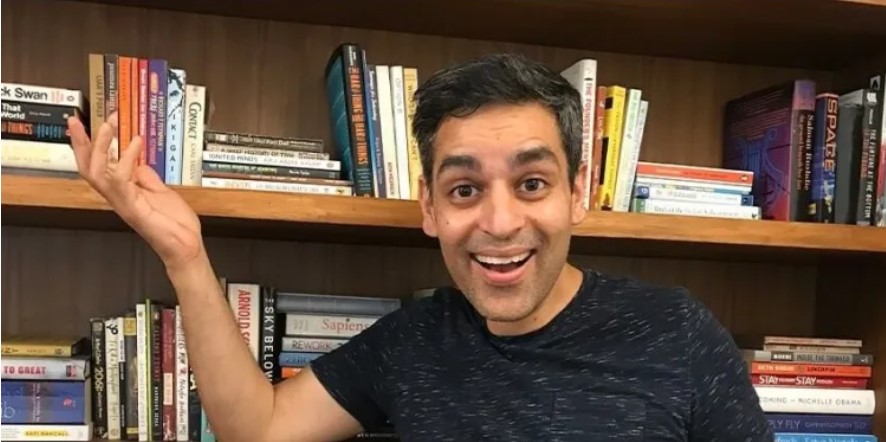

Inflation Affecting Savings? 10 Financial Tips By Ankur Warikoo to Help Money Grow

With India's inflation rates rising and new ways to invest becoming popular, here are some easy financial planning tips from entrepreneur and author Ankur Warikoo.

Ankur Warikoo is the co-founder and former CEO of Nearbuy, a hyper-local online platform that enables customers and local merchants to discover and engage with each other. But interestingly, he is possibly more famous for something completely different – financial planning.

Warikoo shares his ideas and facts through his YouTube channel called warikoo with an amazing 1.7 million followers.

So whether you have been earning for a while without financial objectives or you lack expert guidance in it – Ankur’s talks aids both situations. According to him, twenties is “hands down” the best decade to start your investment.

With inflation and the increase in daily expenses on everyone’s mind, here are some tips from this master to help you spend wisely and save smart:

Needs, wants and investment ratio

1. “The biggest mistake that people make is that they don’t plan”

Financial planning is one key to a peaceful life. Even if one is new into earning a stable income, fix a ratio of needs (rent, electricity, water, petrol, essentials, etc), wants (clothing, travel, other luxuries) and investment. The ratio depends upon the salary and ideally, according to Ankur, it must be 20:30:50.

No loans please

2. “Ideally don’t take a loan or if you do then it should be less”

According to Ankur, if an education loan is taken, do it in your name and not in your parents. It is better to reduce and eliminate loans in your twenties. In case you are planning to invest, it is better to have no such liabilities.

Insure to ensure

3. “Insurance is the best investment you can make because anything can happen, such is life”

Insurance is significant to meet unforeseen expenses in future. Ankur suggests choosing a term plan wisely and he recommends only two types of insurance– life and health. Ideally, 20-25 times your annual salary is the best limit.

Start small

4. “The perfect time period to start investing is when one has just started working”

With a basic salary, there will be less or even no tax-paying needed. When the complete salary is received without deduction, take out a percentage of it (at least 20 per cent) and invest.

Bring in the credit card

5. “One of my resolutions of this financial year is to use credit card more”

There is a 30-45 day interest-free period to use a credit card. So if one is making a full payment, absolutely no interest is required to be paid. It’s like someone giving money for free for these many days.

Bitcoin era on the way

6. “I am going to be aggressive on Bitcoin”

Well, this is not for beginners in investing. Based on how well bitcoin is doing in the market, investment can be done every month which will have great benefit later.

Take steps in advance

7. “The worst thing I’ve done is that I did all of my tax planning in the last quarters”

It is best to start the tax planning during the bef=giining of a financial year or even before that. This way, it can be made minimal and timely for sure.

Books are the best asset

8. “Put no limit on the money you spend on books”

Even though this is a personal take, it is important that we must invest in knowledge. In order to go with the present, one has to be updated and that comes in the form of books or any other medium of your choice. Do not hesitate to spend money on that.

Be a pauper

9. “Live like a pauper in your twenties”

The more you invest with discipline, the more your financial stability increases, which will turn significant in the coming years. For bigger expenses in the future that come in the shape of a house, vehicle or business plan requires money which can’t be arranged in the blink of an eye.

Big no to FD

10. “I have started a war against fixed deposit (FD). I’m ready to fight with the person who can convince me that FD is a good investment”

Especially if you are in your twenties, FD is not an ideal investment option. It only protects money and doesn’t give a chance to grow it. Stocks and equities, in Ankur’s opinion, are the best options to start investment.

Ankur is the former CEO of Groupon India. In 2021, he published his first book Do Epic Shit.

Sources:

Complete Financial Planning for your 20s! | Investing for Beginners 2021 | Ankur Warikoo Hindi Published by warikoo on 19 January 2021.

Financial Goal Setting – How to plan your journey | Ankur Warikoo Hindi Video | WITH CALCULATOR Published by warikoo on 1 July 2021.

Best Personal Finance strategies for 2021 | How to manage your money | Ankur Warikoo Hindi

Published by warikoo on 17 April 2021.

Edited by Vinayak Hegde

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let’s ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

- 97

- 121

- 89

- 167