Startup’s App And Debit Card Teaches Teens The Finance Lessons That Schools Don’t

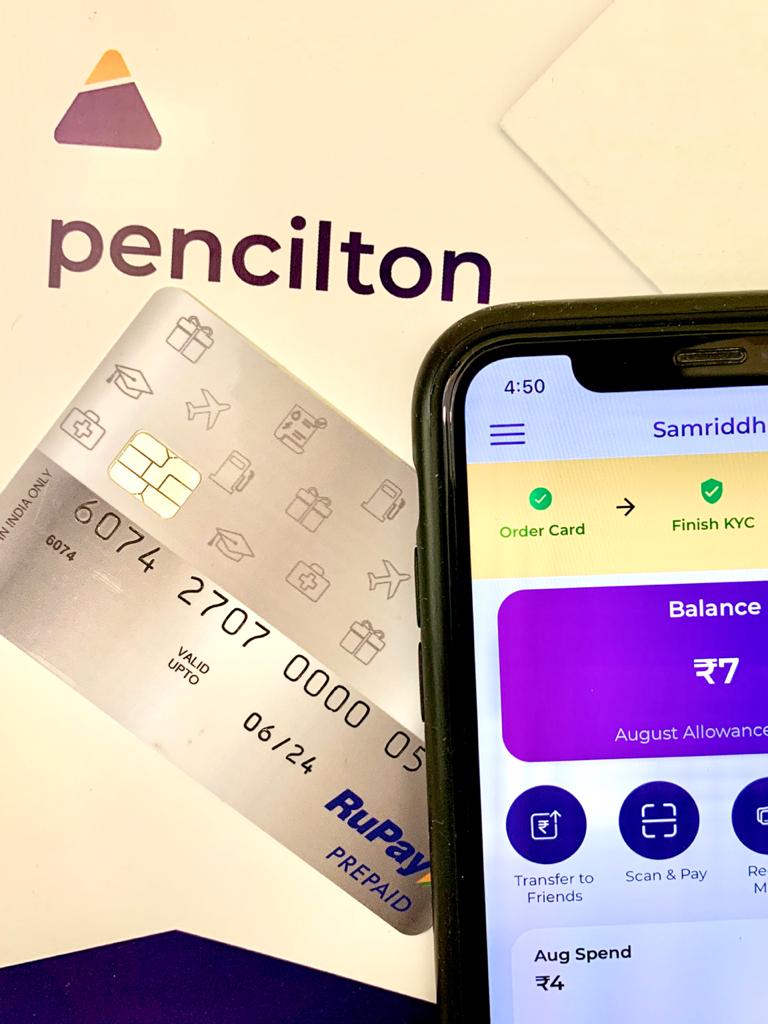

The application named ‘Pencilton’ teaches children personal finance through an app and the pocket money given by parents.

One of life’s most important skills is money management. While most of us are forced to learn this only as an adult, four friends (who are also graduates of BITS Pilani) – Pallavi Tipparaju, Viraj Gadde, Vishwajit Pureti, and Ashish Singh – believe it is important to inculcate finance habits from childhood.

To make it happen, they launched an application named ‘Pencilton’ which teaches children personal finance through the pocket money given to them by parents.

“After graduating from college, the four of us went to do different things for a few years, and we realised, as adults, we had to save money for different reasons such as paying education loans or to purchase something, but none of us knew what to do. These concepts are not taught at school or at home. We are just expected to understand this once we are adults who start to earn. Through the application we aim to introduce the concept of saving money to children in a safe environment,” says Vishwajith

From March 2019 to August 2019, before launching the application, the four friends spoke to parents and their children (above 9th grade) in their close circles about finance. The common responses they got from the parents were – “We want to teach our children how to use money responsibly but don’t know how to”. The children said if they were given money to handle by themselves they would feel like adults and would be responsible with it.

About the finance application

Most parents give their children pocket money on a weekly or monthly basis. This finance is either given as cash or deposited into a child’s bank account. But, through these methods, most parents never know where or how the money is spent and children never learn how to save it.

“Using Pencilton, parents can deposit pocket money into the child’s account and keep track of their daily spend. They can also set goals and tasks for their child to earn rewards such as more pocket money or ‘Pencilton badges’. Goals can be set by the child too – for example, if the goal is to buy earphones worth Rs. 3,000 the application would suggest how they can save up based on their pocket money, to reach that goal within the mentioned period. Parents can set up tasks such as cleaning their room for Rs. 50 or doing their homework on time to earn some money and more,” says Vishwajith adding that they have launched with the concept of savings but also plan to launch other features of personal finance like fixed deposit and recurring deposits soon.

Pencilton has also introduced a prepaid card, powered by RBL Bank, that can be issued to children. The card is linked with the application and can be used as a regular debit/credit card to swipe at commercial establishments or purchase something online.

“There are also parental controls such as adding spend limits and blocking the use of the card beyond a certain time in the day. Another feature on the finance application is a piggy bank that allows children to deposit money into and receive saving challenges from their parents. The concepts of savings are taught to them through short videos. They can also do the same in a gamified manner where they win badges by achieving goals set by the app,” says Vishwajith adding that there are currently 1000 users across India using the application and the card.

Two months ago, Siddharth Prakash decided to download the app and purchase the card for his 15-year-old daughter. He wanted to ensure that his daughter understands the value of money and also keep track of where she spent the same.

He says, “Earlier I would give her my credit card and realised she was getting careless with it. She would spend large sums at restaurants when she went out with her friends, and I would get to know about it only when I received a statement at the end of the month. In the last two months, though it has been quite restrictive on her, it has changed her spending habits. She is keener on saving monthly pocket money and she can tell the difference between what she needs and doesn’t.”

How does it work?

If you are a parent who wishes to help children learn to manage finance, you can download the application on play store or app store. Once it is downloaded, by entering a valid PAN card number you can create an account for yourself and your child. An existing bank account (of the parent) is linked with the application to deposit the pocket money.

After paying a registration fee of Rs 499 a card is issued and delivered via post within a few days.

On the app, there are different logins for the parent and child so that children can set their own goals and view goals assigned to them. On the parents’ version, there is a view of daily expenditure made by the child, the amount they have saved, and set finance goals for them.

“For example, the goal can be to clean their room or finish some work for Rs.50 or more. Once that is marked as complete the amount would get deducted from their bank account into the child’s Pencilton card,” says Vishwajith.

Safety with finance

To ensure the child does not use the card to purchase alcohol or adult-only products, RBL has blocked merchant codes for the same. Apart from that, the card cannot be used at an ATM to withdraw money.

If the card is lost or stolen parents can immediately block it using the Pencilton app and get it replaced by requesting for a new one.

About the finance startup

While research for the finance application started in March 2019, the company was formally launched in August 2019. The application was developed in-house and officially launched in August 2020.

Headquartered in Hyderabad, the startup was bootstrapped by the four and it also received a grant from HDFC bank last year.

To know more, visit their website or follow them on Facebook.

(Edited by Vinayak Hegde)

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let’s ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167