27-year-old sales executive Anuj Kumar Srivastav draws a monthly salary of Rs 25,000. Imagine his surprise when he found that he was named as a Director of about 13 companies and had ‘allegedly’ transacted in over Rs 20 crores within a few months.

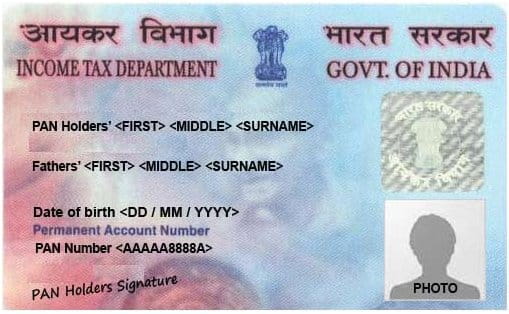

An Income Tax notice sent to Anuj was what helped him take note of the fraud that was being done in his name. He visited the bank where the alleged transaction took place. He was shown a copy of his voter ID, PAN card, and photograph. However, luckily for him, the signatures on the forms were forged.

Read all about that here.

With the number of places where we leave our PAN numbers without thinking twice, identity theft is a real cause for concern.

Safeguarding the physical copy of the PAN card no longer assures that your number is not being misused.

Misusing your PAN card details for high-ticket purchases or benami property transactions is something that occurs quite frequently. A copy of your PAN card or its number can be quoted in transactions which you may not even be aware of.

Here’s how to safeguard from potential PAN card fraud:

Unfortunately, you may get to know of the illegal use of your PAN number only six months after the transaction.

Once you do, you can check for benami transactions by going through Form 26AS, which is a consolidated statement of tax deducted, along with other details.

In case you are a non-tax paying PAN card holder, you may not be able to check this form. The Income Tax Department will require the PAN card-holder to prove that the transaction was not carried out by them, and also give details on their source of funds.

Here’s how to protect yourself from identity theft:

• Your personal details like date of birth and place of birth need not be public information. So make sure you don’t share these with others apart from your immediate family.

• Ensure that you are absolutely certain about where and why you are submitting your details. And always write the date on the documents.

• Additionally, you could also click a picture of the documents being submitted with the date for future reference.

Keep track of your documents and ID cards. Every once in a while, do check them to see if they are in order.

Photo Source: Wikimedia Commons

• If any documents are missing, then file a First Information Report at the earliest.

• If you have saved your bank details, passwords, etc. on your mobile handset, remember to delete them when you are changing phones.

While we work prudently on most issues, we sometimes forget these small points, which could lead to huge losses. Hope this article helped reiterate some of the things that we already know.

(Edited by Shruti Singhal)

Like this story? Or have something to share?

Write to us: contact@thebetterindia.com

Connect with us on Facebook and Twitter.

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?