Did You Know? The Post Office Offers Savings Accounts at ₹50 & ATM Services Without Transaction Fees

Armed with low-cost saving schemes, new ATMs and innovations in the works, India Post is emerging as a cost-effective alternative to conventional banks.

Between serpentine queues at banks and perennial cash crunch at ATMs, having cash at hand has become something of a luxury in India. There’s also the question of spiking minimum balance at banks and transaction fees, making it difficult for rural communities and working classes to access reliable banking services. While banks grapple to offer the best rates, the humble post office is quietly offering a substitute.

With ATMs being set up around the country and lower saving schemes, India Post is emerging as a cost-effective alternative to conventional banks.

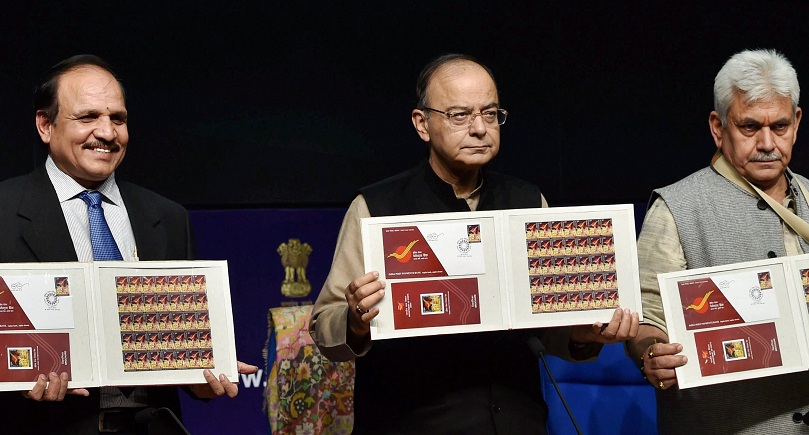

Image source: Twitter

Image source: Twitter

In addition to delivering snail mails and money orders, India Post has been running a number of small savings schemes since 1882, including savings and recurring accounts as well as time deposits. Opening a bank account in the post office takes a mere ₹20 and the minimum balance to be maintained is ₹50.

“We want to serve everyone,” says KVLN Murthy, senior superintendent of post offices for Visakhapatnam division, adding that there are thousands of postal savings account holders in his district alone.

While these cost-effective saving schemes have existed for a while, 2016 witnessed a sustained effort towards digitalising and consolidating India Post operations.

Its most recent development is a series of India Post ATMs, that are being opened around the country, from Jammu & Kashmir to Kerala.

Image source: Twitter

Image source: Twitter

According to Murthy, these zero-transaction-fee ATMS have helped them expand their services to everyone, from the poorest of poor to the well-established.

“The India Post ATMs are not different from bank ATMs in their functions,” he says. “The one advantage we have is that anybody can open an account at the post office and avail of an ATM Card. These cards can be used at India Post ATMs anywhere, as well as bank ATMs.”

Opening a savings account is simple, and requires an identification document such as an Aadhaar card and two photographs. While the minimum balance for regular accounts is ₹50, availing one with a cheque book facility requires users to have at least ₹500 at all times.

You might also like: How India Post Payments Bank Can Be a Game Changer for Financial Inclusion

As part of the Digital India initiative, the government aims to offer Core Banking Solutions (CBS), ATM and internet and mobile banking for account holders. With a network wider than the biggest bank in the country, it has been reported that in December 2016, 23,091 post offices have migrated to CBS and over 600 ATMS have been established in various parts of India. However, the internet and mobile banking services are yet to be launched.

The government is also running pilot projects of the India Postal Payments Bank in Raipur and Ranchi.

Unlike India Post, IPPB is operational under the aegis of the Reserve Bank of India, and seeks to bring the best of banking and postal services under one roof. A collaboration between the two bodies has not been announced yet, but may prove to be a useful measure if implemented in the future.

Presently, India Post has over 1,50,000 branches and offers postal access to some of the most remote locations around the country. The department has a long way to go, but there’s certainly hope for a department which is often considered obsolete in the technological age.

Follow India Post on Twitter for updates and complaints redressal or call the ATM helpline on 1800 425 2440.

Like this story? Or have something to share? Write to us: [email protected], or connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167