New, All-Improved, More Secure PAN Cards: Here are the Features That Make It So

The Income Tax Department has decided to make Permanent Account Number (PAN) cards tamper-proof to curb illegal and fraudulent practices in taxation and banking.

The Income Tax Department has decided to make Permanent Account Number (PAN) cards tamper-proof to curb illegal and fraudulent practices in taxation and banking. The central authority directed all the TIN (Tax Information Network) facilitation centres and Pan Card Centres to issue the newly-designed PAN Cards from January 1, 2017.

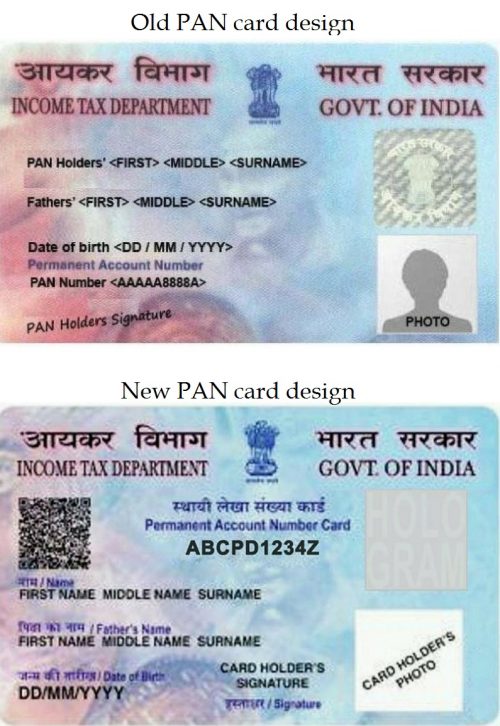

The new PAN cards come with tamper-proof security features along with added features like bilingual content in Hindi and English, and more detailed personal information of the card holder.

Image source: (old) Wikimedia Commons. (new) Facebook

According to a report in The Economic Times, the new PAN cards are being printed by NSDL (National Securities Depository Ltd) and UTI ITSL (UTI Infrastructure Technology and Services Ltd).

“The distribution of new PAN cards kicked off on January 1. We have automated the data and made the PAN cards error-free,” said an unnamed official.

The newly-designed cards will be issued to new applicants, while those who have the old PAN cards will have to apply for the new ones. The new PAN cards have the following features:

- Quick Response (QR) code with details of the PAN applicant is printed on the card for enabling verification. It will provide all the details at once when the card is produced before any authority. This way it won’t be possible for the cardholder to tamper or misrepresent any information related to the card.

- Legends have been incorporated for particulars like name, father’s name, and date of birth.

- The position of PAN and signature has been changed.

Among other changes, the Central Board of Direct Taxes (CBDT) has amended the income tax rules and instructed all banks to link the Permanent Account Number or Form No. 60 (where PAN is not available) to all existing bank accounts by February 28, 2017. PAN cards have also been made mandatory for any transaction above Rs. 2 lakh.

There are currently more than 25 crore PAN card holders in the country.

Featured image source: Facebook

Like this story? Or have something to share? Write to us: [email protected], or connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167