TBI Blogs: Demonetisation Has Made the PAN Card Indispensable. Find out Why You Need One, and How to Get It

With the demonetisation drive in full swing, many people are beginning to realise the importance of having a PAN card. Read on to find out more about this increasingly important identification document, and how to go about getting one if you don’t have it already.

With the demonetisation drive in full swing, many people are beginning to realise the importance of having a PAN card. Read on to find out more about this increasingly important identification document, and how to go about getting one if you don’t have it already.

The importance of the PAN card has significantly increased since November 8, 2016, when the demonetisation drive began. This is because banks have been instructed to accept deposits or exchange old Rs. 500 and Rs. 1,000 notes only after the submission of a PAN card. Now, many Indians simply do not have a PAN card, which is why, at Vakilsearch, we’ve seen a huge increase in inquiries regarding everything related to the PAN card. This article seeks to address everything you need to know about getting a PAN card, and even what you need to do if you’ve lost one.

Why does everyone need a PAN Card?

The PAN, or Permanent Account Number, is a unique identification number that seeks to tie all the financial transactions conducted by its holder. This is why you need a PAN to open a bank account, invest in a mutual fund, buy/sell property, and even open a Fixed Deposit (FD). Even foreigners earning in India need a PAN card. Businesses, NGOs, and even Hindu Undivided Families (HUFs) need PAN cards of their own. As much of India’s economy still runs on cash, many have never bothered with it. But this may no longer be possible, as the government is cracking down on tax evasion.

As you may have noted though, a PAN is used to check the viability of all financial transactions, not just so that the government can calculate how much tax you owe.

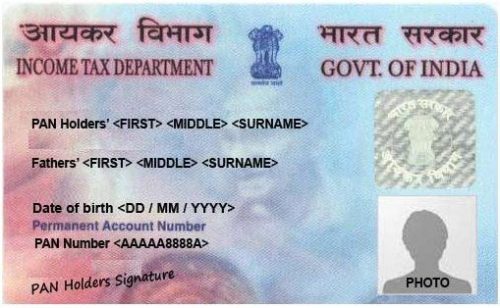

What is a PAN Card?

The PAN, a 10-digit number, is provided by the Income Tax Department under the supervision of Central Board of Direct Taxes, and is issued as per the rules set by the Income Tax Act, 1961.

PAN Card Application

A new PAN card can be obtained by any individual, business or HUF if they have the relevant documents and do not already posses a PAN card.

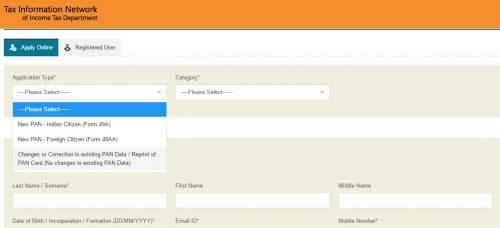

The new government process has been simplified, with the introduction of an online application form. Now, it is just a matter of filling in the online form (Form 49A for Indian citizens and Form 49AA for foreign nationals).

Let us look at the steps involved in the procedure:

a. The NSDL, as mentioned earlier, has built an easy-to-use form for applying for a PAN Card. The online services section of its website will first require you to register yourself. Select which category you are applying under (individual, partnership firm, etc.) and the form you will be using (Form 49A or 49AA). Enter your name, surname, phone number, and e-mail ID to get started. In case you are applying on behalf of a company, then enter the name of the registered entity.

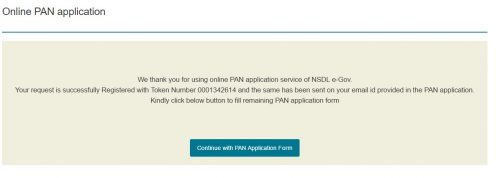

b. When you enter these details, you will be given a token number. If, for any reason, you are unable to complete the form in one go, you will need to enter this number to continue from where you left off. The number is also e-mailed to your registered e-mail ID.

c. Now you start with the application by selecting whether you will be submitting your documents physically or digitally, through a valid digital signature certificate (Aadhar Card is essential).

d. The form now takes just three minutes to complete. All you need to do is enter your parents’ names and dates of birth and select how you are earning your income (salaried, business, etc). You also need to enter your address and, finally, the documents you will be sending in (select from the lists available).

e. Once this is done, you will have to make a payment of Rs. 107, which will generate an ‘Acknowledgement Receipt’. You must attach the identity and address proofs that you have mentioned in the form with this receipt, and send them to the Income Tax Department. Two coloured photographs also need to be sent in. Mention ‘Application for PAN (Acknowledgement Number)’ on the envelope.

f. The process is only deemed complete when the proofs are sent to the Department at Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Ltd., 5th Floor, Mantri Sterling, Plot no. 341, Survey no. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune. – 411016.

g. The income tax department will verify the details, check the documents, and if found relevant, will send the PAN card to the address mentioned in the application form within three weeks. In case it does not arrive within this time period, you can always check the status of your PAN card.

Have you lost your PAN Card?

Since it is not an uncommon occurrence to lose the card or misplace it, the government has given provisions to apply for the same through the above-mentioned procedure.

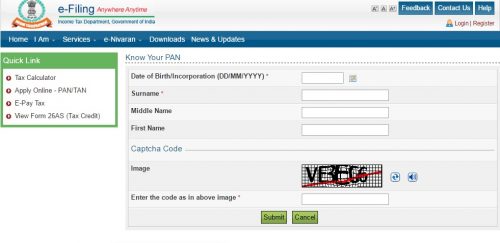

Don’t Remember Your PAN?

There’s no cause for worry if you simply don’t remember your PAN. Simply enter your name and date of birth into this form and you will be given your PAN. Alternately, you could check any of your tax returns or bank details.

Should I lodge a complaint?

If your PAN has been stolen, you should lodge a complaint as it could be used fraudulently. Once you receive your copy of this complaint, you should attach it with your application for a new PAN card along with the other documents.

PAN for Non-Individuals

NGOs, corporates, and partnerships must all apply for PAN cards too. The procedure for the application, and even the cost, is the same; however, organisations need to submit different documents. Whereas an individual would submit personal documents, companies must submit a copy of their Certificate of Incorporation and LLPs must submit a copy of the LLP Agreement.

Feature Image: Designed by Vvstudio / Freepik

To know more about the PAN Card and related documents and queries, visit the website of the Tax Information Network.

Like this story? Or have something to share? Write to us: [email protected], or connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167