Banking in the Hills – How SEWA Bharat is Enabling Financial Inclusion in Remote Locations

Read about the efforts of a unique financial inclusion programme that aims at empowering women in the the rural parts of the hilly state of Uttaranchal where employment opportunities are scarce, infrastructure is patchy and banks are practically virtually non-existent.

Read about the efforts of a unique financial inclusion programme that aims at empowering women in the the rural parts of the hilly state of Uttaranchal where employment opportunities are scarce, infrastructure is patchy and banks are practically virtually non-existent.

Advocating the cause of women empowerment, the Finance Minister in February announced ‘women-only’ banks to mixed reactions. While some welcomed the idea declaring it a clarion call, others saw in the move an abject disconnect between the burning issue and the offered solution. Banks for women, many hailed, were novel budding ideas even though many such banks were functioning away from the public eye.

The Self Employed Women’s Association (SEWA), founded by Ela Bhatt in Gujarat, is a labour union of poor self-employed women workers in the informal economy. In the month synonymous with the budget, Ela Bhatt was conferred with the coveted Indira Gandhi Prize for Peace, Disarmament and Development for a lifetime devoted to empowering women in India and elsewhere through grassroots entrepreneurship, healthcare, micro-finance, micro-insurance among several others.

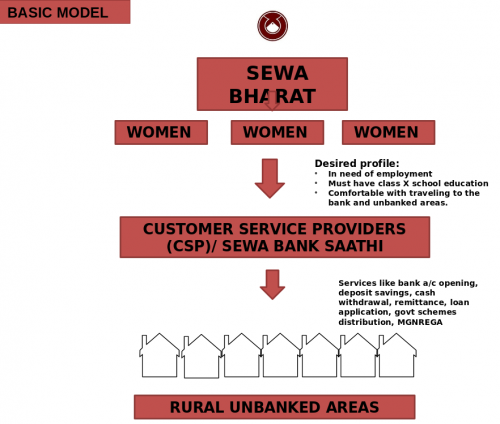

Working as a federation, SEWA Bharat operates a unique program in the hills of Uttarakhand. More than 75% of Uttarakhand’s population comes under the category of ‘rural’. Owing to the high altitude, poor connectivity with roads and thinly spread population, bank services in such areas are often very limited. In order to bridge the chasm between rural areas and banking services, SEWA in collaboration with the State Bank of India (SBI) began a unique initiative of financial inclusion in 2009.

SEWA-SBI Financial Inclusion Programme employs selected women from the community as Customer Service Points (CSPs). SBI issues a Business Correspondent Code to each of the CSPs. Technology provider, A little World, generates a unique CSP ID and issues them Point of Service (POS) Machines.

With the help of these machines, no-frills accounts are opened by recording identities of customers through fingerprints, voice recording and photographs thereby enabling a spectrum of transactions. Deposit savings (Fixed Deposit/Recurring Deposit), withdrawal, remittance, loan applications in addition to pension distribution are readily made available through this model of financial inclusion. Once the data is entered and linked to the corresponding account, it is uploaded to SBI’s Mumbai server through GPRS culminating with the registration of the account.

Prem Lata, an enthusiastic Customer Service Provider, elaborates on the benefits of the programme:

In the hills, banks are scarcely located and every trip to the bank demands time and money. In addition to this, customers attribute heavy documentation work with opening of bank accounts. SEWA-SBI Financial Inclusion Programme makes the bank come to the customers and requires minimal documentation.

Anu, one of the account holders, wears a satisfied smile when a question about the programme is posed, “We used to feel very unfortunate in the absence of banking services. With this programme, we are not only saving money but are also more aware of government schemes we can avail.”

The rural population of Uttarakhand primarily consists of the elderly, women and young children. Men regularly venture out to the cities looking for better employment opportunities. Agriculture, albeit difficult, alongside animal husbandry, have been the main occupations of these women. For long, the state has struggled to retain these people through local employment and income generation schemes. Through this unique model, employment generation for women has grown manifold and the gap between financial inclusion and financial stability has narrowed.

You can follow their work on facebook.

This story made me

- 97

- 121

- 89

- 167

Tell Us More

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.