5 Things to Know About Atal Pension Yojana, Govt’s Pension Scheme for the Unorganized Sector

All you need to know about the 'Atal Pension Yojana' , a retirement scheme initiated by the Government of India, for the unorganised sector.

In the 2015-16 budget, the Government of India launched a new scheme called Atal Pension Yojana, in order to encourage the working class in the unorganized sector to save for retirement.

The scheme, which is administered by the Pension Funds Regulatory and Development Authority, can be availed by anyone who has a bank account, an Aadhar card and a mobile number.

Photo source: sapost.blogspot

Here are the five things you need to know about the Atal Pension Yojana:

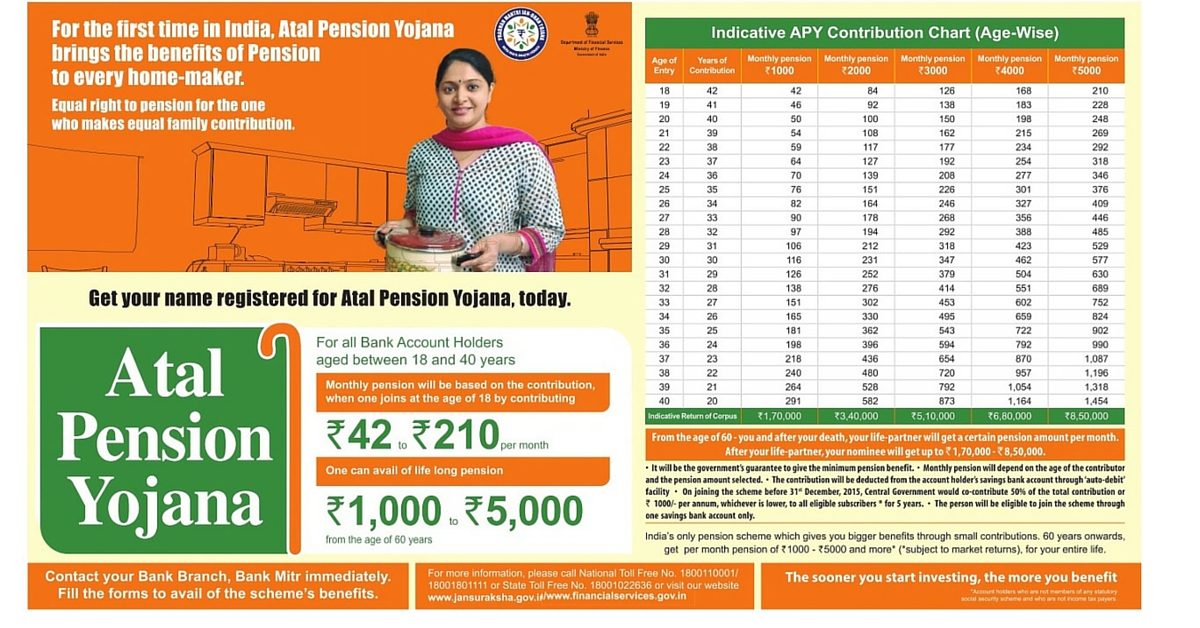

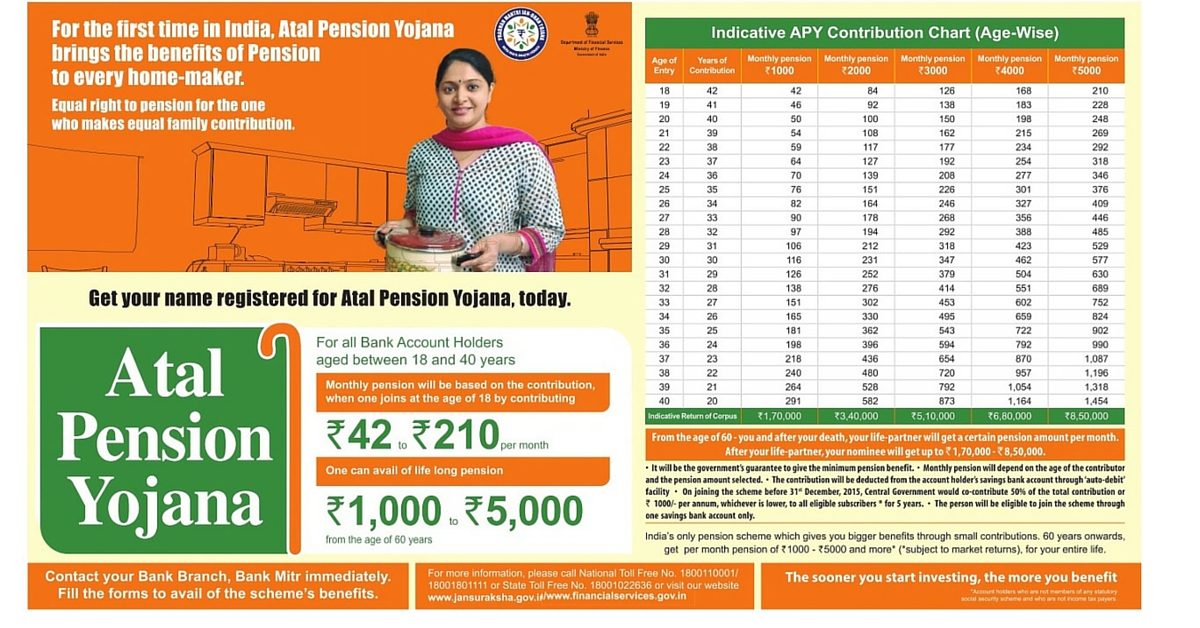

- Anyone in the age group 16-40 can subscribe to the Atal Pension Yojana. The age for exit from this scheme and start of pension is 60. So the minimum period for contributions by the subscriber is 20 years.

- The monthly pension will depend on the contributions made by the subscriber. The minimum amount of monthly pension will be Rs 1,000 and the maximum will be Rs 5,000.

- The Government of India will also contribute 50% of what the subscriber contributes per month, or Rs 1,000, whichever is lower.

- However, the government has asked the banks to collect penalty on delayed payments, which can range from Re 1 to Rs 10 per month based on the amount of contribution.

- You can help your driver, cook or domestic help sign up for this scheme by taking them to the nearest public or private bank and filling out their details. Also, you can help them register online by filling up an online subscription form.

Learn more about this scheme here.

Like this story? Or have something to share? Write to us: [email protected], or connect with us on Facebook and Twitter (@thebetterindia).

This story made me

- 97

- 121

- 89

- 167

Tell Us More

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.