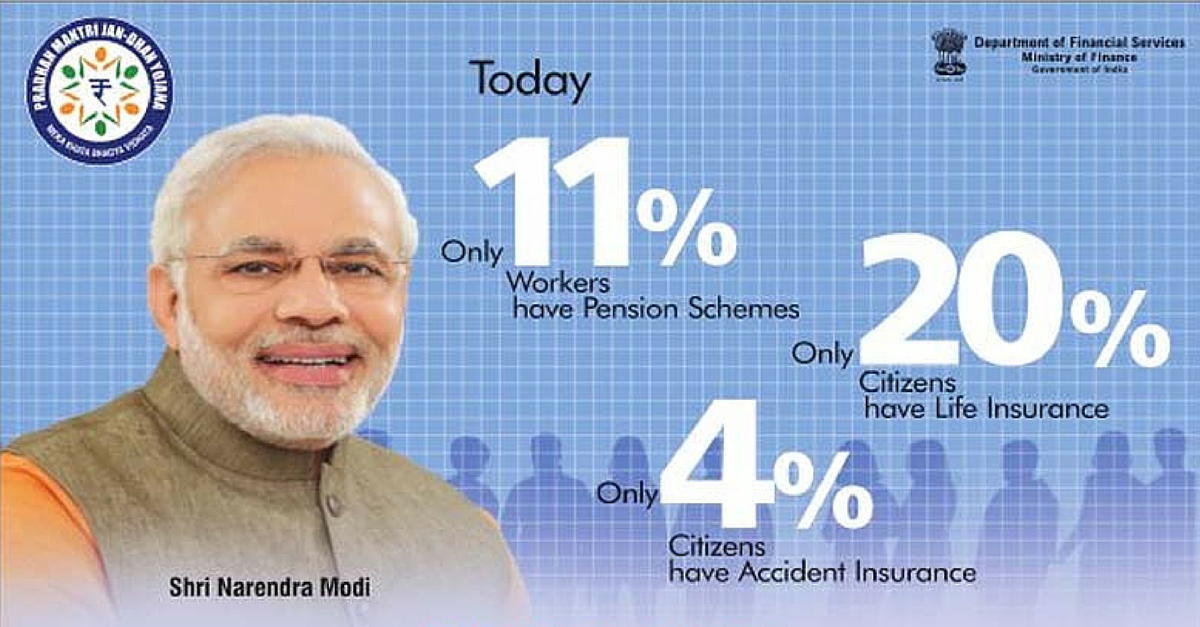

3 social security schemes of Narendra Modi that promise Insurance and Pension for All

On Saturday, in Kolkata, Narendra Modi announced the launch of three new Security Schemes which aim to expand the horizon of financial and social security dramatically in the country.

In what seems to be a groundbreaking move, Prime Minister Narendra Modi embarks upon a path which aims at providing the Indian population with a significantly higher level of financial security. He declared the establishment of three new security schemes: two which are aiming at insurance, the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and the Pradhan Mantri Suraksha Bima Yojana (PMSBY), and one aiming at pension, the Atal Pension Yojana (APY).

According to the Economic Times, a staggering 80% of the population fails to receive any kind of financial or social security benefit from the government.

Since around 86% of the employed population of India works in the unorganized sector, as per the National Commission for Enterprises in the Unorganized Sector (NCEUS) report of 2005, the primary agenda of these schemes is to provide benefits to the aforementioned section.

The main attributes of the three schemes are listed below:

1. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMSBY) – This scheme, aimed at the age group of 18-70, provides a sustainable one year accidental death-cum-disability insurance of Rs 2 lakh, for both partial and permanent disability. It shall be available to each account holder of a savings bank account holders. The premium charged is that of Rs 12 per annually per subscriber.

2. Pradhan Mantri Suraksha Bima Yojana (PMJJBY) – This scheme, aimed at the age group of 18-50, provides a renewable one year life insurance of Rs 2 lakh, covering death irrespective of cause. This scheme, just like the PMSBY, is also accessible for all account holders of a savings bank. The premium charged is that of Rs 330 annually per subscriber.

3. Atal Pension Yojana (APY) – This scheme, aimed at the age group of 60 and beyond, provides subscribers with a fixed minimum pension of Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000 or Rs 5,000 per month. This range is completely dependent on the amount of cumulative allowance the subscriber has made between his years from 18 up to 40. This scheme is also aiming to prioritise the unorganised sector of India.

The launch ceremony took place in 115 venues across India at the same time. It was as though Modi wished to cover the whole of India with a blanket of security.

This story made me

-

97

-

121

-

89

-

167

Tell Us More

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.