What’s a CIBIL Credit Score, Why It Matters & How to Check Yours Online

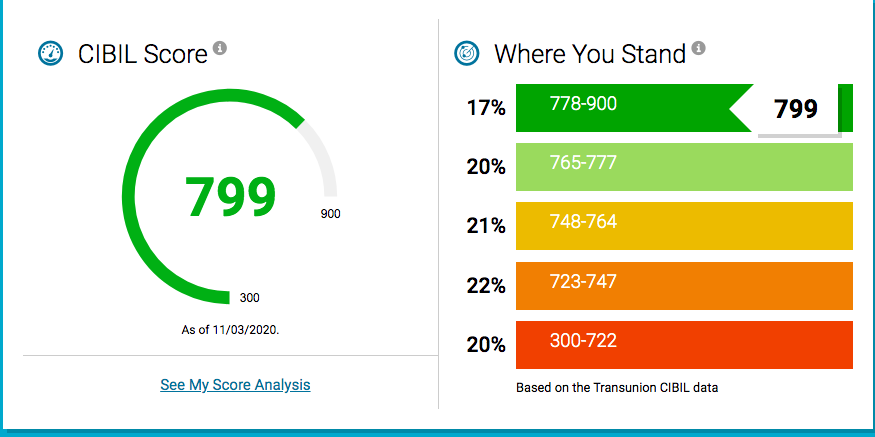

When one applies for a loan or a credit card, the banks will check your recent CIBIL score (last six months). In general, a score above 700 is considered excellent, though it may differ from bank to bank.

Planning to take a loan or a credit card? Then you need to know your CIBIL score. Think of the CIBIL score as a sort of a report card of your finances which helps banks and lending institutions assess whether or not you can be given a loan.

In this article, we will look at what a CIBIL score is, why it should matter to you, and how you can check your score online.

What Is A CIBIL Score?

Established in August 2000, the Credit Information Bureau (India) Limited (CIBIL) is the first credit information company in India. A CIBIL score is one of the most important factors that almost every financial institution checks when they receive credit applications from individuals.

Given that CIBIL has affiliations with almost every bank, they collect and collate information about individual and corporate account holders to gauge their creditworthiness. Having a high CIBIL score denotes not only excellent financial discipline but also integrity.

When one applies for a loan or a credit card, the banks will check your recent CIBIL score (last six months). In general, a score above 700 is considered excellent, though it may differ from bank to bank.

Why Is The CIBIL Score Important?

Once an applicant fills out the application form to either secure a loan or get a credit card, the lender will first and foremost check the CIBIL score to ascertain whether or not the applicant is eligible for the loan/credit card.

If the CIBIL score is low, the lender may not even consider the application further and reject it. If the CIBIL Score is high, the lender will look into the application and consider other details to determine if the applicant is credit-worthy.

What the CIBIL score helps in doing is act as a sift through which, only those eligible can move forward. While the decision to lend is solely dependent on the lender and CIBIL does not, in any manner, decide if the loan/credit card should be sanctioned or not, it helps in the lender making that decision.

What’s A Good CIBIL Score?

The CIBIL score is a three-digit numeric summary of your credit history. The report will range from 300 to 900, depending on how you have fared. The closer your score is to 900, the higher are the chances of your loan application getting approved.

Between 850 to 900 – This is an excellent score and shows that you have never defaulted on any payment.

Between 750 to 850 – A majority of the loans sanctioned are for those whose credit rating falls in this bracket. Scores above 800 are considered high and securing a loan with this score is easy.

Between 700 to 750 – This is a good score for secured loans, however, for unsecured loans the banks might want to impose a slightly higher rate.

Between 500 to 700 – This score might make it difficult for an individual to secure personal loans. This shows that you have delayed or defaulted in the recent past.

Between 300 to 500 – This is considered as a poor score and securing a loan will be very difficult. This also means that the individual must work towards repairing their credit history.

Some of the factors that could negatively impact your score include:

- Late payment of EMIs

- Defaulting on the EMI payment

- A high percentage of unsecured loan such as personal loans

- A high level of credit card expenditure

- Giving a guarantee for a loan, which the borrower defaults on will impact your CIBIL score

How can you check your CIBIL score online?

- Log in to the official website here

- On the left top corner click on the tab which says ‘Personal’

- Click on – ‘Get Yours Now’

- You will be directed to this page, where you will have to fill out your details, which includes name, date of birth, a password to access the site, and an ID proof

- Once you log in, an OTP will be sent to your registered mobile number

- Upon entering the OTP, you will be directed to a dashboard where your CIBIL score will be displayed

- You have two options, either to pay a certain charge and get a detailed score report or opt for the free report

It is always good to check your CIBIL score before you apply for a credit card or a loan.

Also read: IT Returns & Insurance: Bengaluru Startup Helps Ola & Uber Drivers Become Money-Smart!

(Edited by Saiqua Sultan)

Like this story? Or have something to share?

Write to us: [email protected]

Connect with us on Facebook and Twitter.

This story made me

- 97

- 121

- 89

- 167

Tell Us More

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.