Setting Up Your Own Startup? 5 Legal Basics Every Entrepreneur Should Know!

While establishing a venture, an entrepreneur has to choose from sole-proprietorship, partnership firm, or a limited liability partnership (LLP), and private limited company. Each of these come with their own set of legal specifications.

Roy L. Ash, a renowned financial wizard, once said: An entrepreneur tends to bite off a little more than he can chew hoping he’ll quickly learn how to swallow it.

An entrepreneur must know a little bit of everything. While there is no easy substitute for expert knowledge, a framework of basic concepts is useful as a ready reckoner for the daily challenges that an entrepreneur faces.

In this article, we list out some basic legal and regulatory knowledge that one must possess before venturing out in the arena of proprietorship.

1. Understanding and choosing the right venture

While establishing a venture, an entrepreneur has to choose from sole-proprietorship, partnership firm, or a limited liability partnership (LLP), and private limited company. Each of these come with their own set of legal specifications.

For example, while registration is mandatory for a limited-liability and private limited company, it is optional in case of partnership and a sole proprietorship. In terms of liability towards the venture, sole proprietorship and partnership have unlimited liability, whereas the liability is limited to the extent of the contribution made in an LLP and private limited company.

Read the laws governing these set-ups carefully to avoid penalisation for non-compliance.

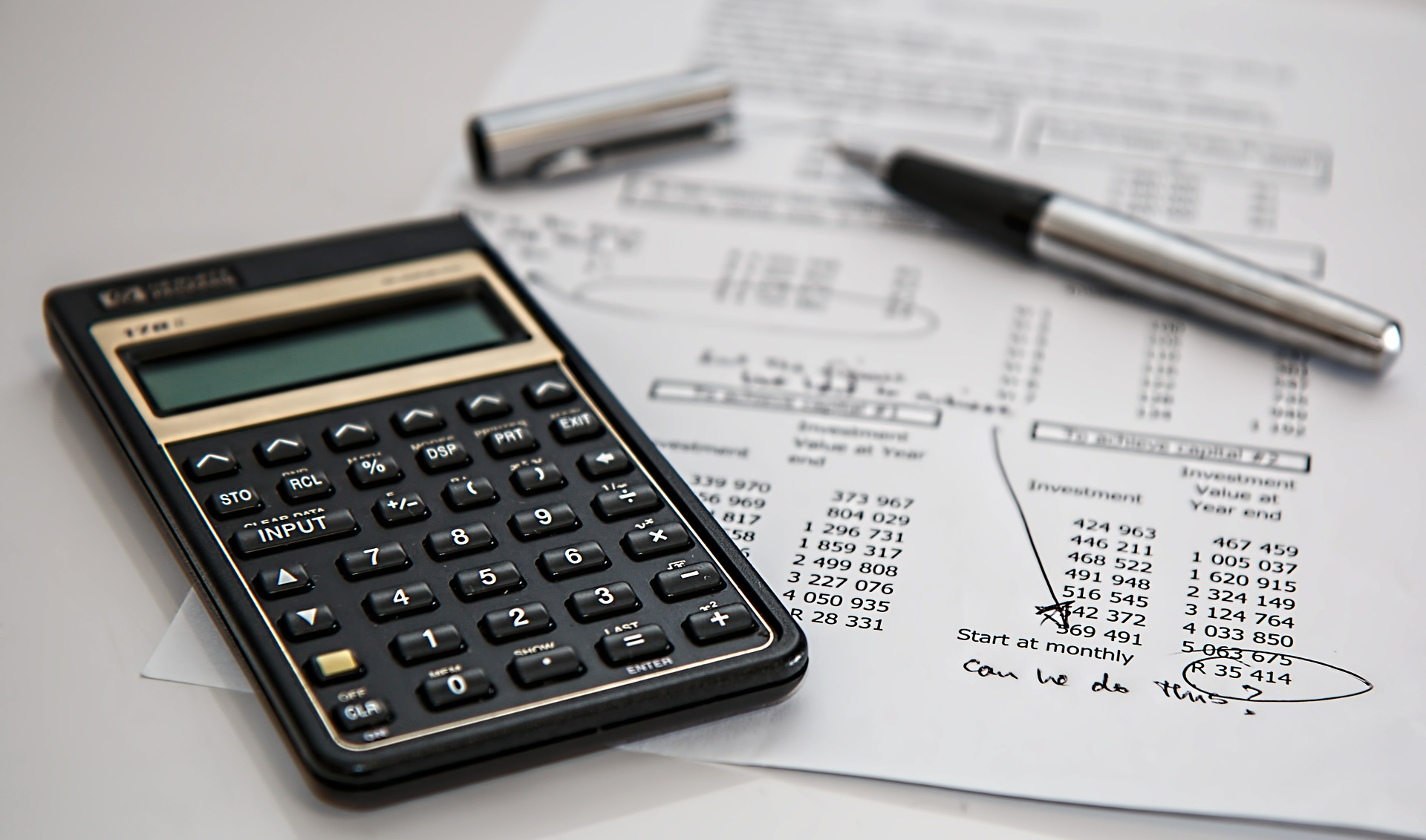

2. Have basic taxation knowledge

Taxation laws depend on the type of business you plan to set-up. Tax laws also change according to the geographical region and the business/product.

Stay updated on all the changes brought in by the central and state governments, tax deducted at source, and the GST regulations among others, to avoid slipping up, or get taken for a ride by vendors or customers.

3. Be aware of labour laws

Some of the critical issues that need the attention of the entrepreneur are:

- Setting the minimum wages

- Gratuity

- Provident Fund payments

- Fixing of weekly holidays

- Maternity benefits

- Establishing sexual harassment policies

- Bonus amount.

If you are in breach of any of the stipulated labour laws, then you will not only attract penal liabilities but will also have to face negative reviews.

Consider outlining the details about salary, the scope of work and stock options (if any) with your employees.

Remember that happy employees are more efficient and productive. Spending some time and energy on designing a good employee policy can help in the long run. A well-drafted employee policy can help retain and attract talent.

4. Trademark protection and Intellectual Property (IP) rights

If you have developed something unique, then you ought to protect it. Patent your innovative product or process. Apply for a trademark that gives you the exclusive right over your product. Conduct timely IP audits and file the accurate trademark/copyright/patent claim to protect your business and in turn, increase profits too.

5. Management of contracts

All your agreements must be documented in the form of a valid contract. A contract makes it easy to enforce action and also take action in case of any default or inaction.

For a start-up, Non-Disclosure Agreement (NDA) is also of vital importance. Since a start-up thrives on new ideas coming in from different people in the team, it is essential to protect those ideas and ensure that they stay within the company.

A court of law can penalise a breach of an NDA.

6. Check the incentives that the Government is offering

The government of India offers specific benefits to start-ups. For example, if your total annual turnover is lower than Rs 25 crore, you can avail tax exemptions.

To avail these benefits, it may be necessary to have your accounts audited – it helps to have an auditor by your side to look into your books. It may also help you to understand how the business is performing financially.

Also Read: Daughters Are Precious: 18-YO Raises Money To Educate 108 Girls!

(Edited by Saiqua Sultan)

Like this story? Or have something to share?

Write to us: [email protected]

Connect with us on Facebook and Twitter.

This story made me

- 97

- 121

- 89

- 167

Tell Us More

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.