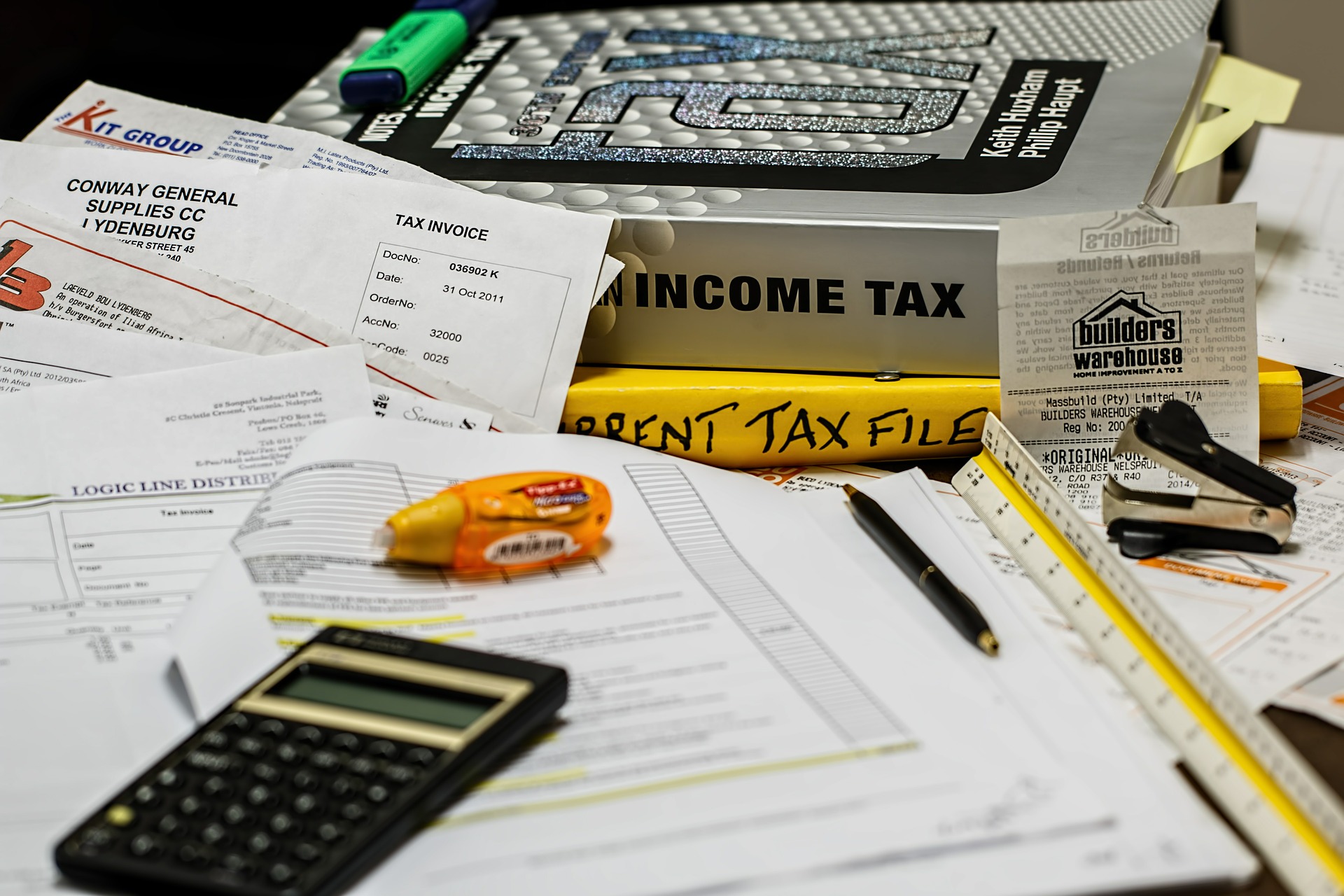

Received a Notice from the Income Tax Department? Here’s What You Should Do!

Before you proceed, please be aware that as of October 1, 2019, all IT notices will be issued through a centralised computer system.

Most people would get jittery if they were to receive an IT notice.

However, just because you receive a notice does not mean that you have committed a crime. There are various reasons why this could happen, and in addition to listing those reasons in this article, we will also offer solutions.

Before you proceed, please be aware that as of October 1, 2019, all IT notices will be issued through a centralised computer system.

This handmade canvas folder with a blue warli border will help keep all your important bills and paper in one place. Click here to buy.

All IT orders and notices will also carry a Document Identification Number (DIN) and any tax notice not carrying the unique number will be considered as not issued unless the manual notices are issued following the procedure as specified under the law.

So check any notice or order that you receive from the IT department carefully before you proceed with your course of action.

1. Late IT Returns Filing

- A notice might be sent across in case you have not filed your tax returns by the stipulated date. If this is the case, then do not delay any further, as this can lead to a penalty.

- The IT department is at liberty to remind you about unfiled returns for the previous six assessment years.

- If you miss the deadline and file a belated return for the current financial year before December 31, 2019, then you may have to pay a penalty Rs 5000. However, this penalty will increase to Rs 10000, if the IT returns are filed on or after January 1, 2020. If there are taxes unpaid in such cases of delayed filing, the assessee is charged 1 per cent interest per month from the due date.

Solution: Ensure that you reply to the notice within the stipulated time. If the notice has reached you by mistake and you are not liable to pay the taxes or have already done so, do respond to the notice with all relevant documents to support your claim.

2. Mismatch in Tax Deducted at Source (TDS) claimed

Photo Source: Pixaby

- This is one of the most common reasons why an assessee is sent a notice. While you file your returns, the TDS amount should ideally be the same as mentioned in Form 26AS and Form 16 or 16A.

- This could be because of an error in filing by your employer or deductor.

- Form 26AS is a statement containing details of all the taxes that are deducted during the financial year from your income and deposited against your PAN to the government. Apart from taxes deducted by your employer from your salary or by the bank from interest income, Form 26AS also shows the taxes that are deposited by you as advance tax or self-assessment tax.

Solution: In this report, Amarpal S Chadha, Tax Partner and India Mobility Leader, EY India, said, “As a precaution, before filing the return of income, one could check the TDS reported in the Form 26AS and ensure that the TDS is correctly reported by various deductors and then proceed to file the return of income. [In the] case of mismatch, the assessee, has to approach the respective deductor to update their reporting.”

If you find yourself in a similar situation, contact your employer or deductor immediately to get this discrepancy sorted out.

3. A discrepancy in returns filed

- All incomes received or accrued during the previous financial year must be mentioned.

- Before you sit down to fill out the form, make a note of all the income you have received over the course of the year. You must list everything to avoid getting pulled up or penalised later.

- Many assessees forget to report interest earned from savings bank accounts, fixed deposits, recurring deposits, etc., under the head ‘ income from other sources,’ so do ensure that you have a list of it all before you submit your form.

Solution: Remember that you, as a tax-payer, are duty-bound to declare all bank accounts held by you. Even if you are exempt from filing IT returns, and your income is tax-free, you still have an obligation to declare the same.

4. Wrong ITR form

While filing the IT returns form, please be extremely careful about the category under which you fall.

- ITR 1 (Sahaj) is applicable for a resident individual/Hindu Undivided Family (HUF) earning income up to Rs 50 lakh from salary, having one house property, and deposits.

- ITR 2 is to be filed for an individual/HUF with any income from ITR 1, more than one house property, lotteries, capital gains, foreign assets or as a director in a company.

- ITR 3 is for an individual/HUF with any income under ITR 2 and who owns a business, freelances or is a self-practising CA, lawyer, doctor, or teacher. ITR 4 (Sugam) is for an individual/HUF/Partnership firm with any income under ITR 1 and presumptive income (below Rs 2 crore) from business or profession under Section 44AD or 44AE.

Solution: In such cases, the department allows time of up to 15 days to respond to the notice. If you ever receive this notice, make sure you file the revised returns before the deadline. If you fail to do so, your returns could be invalidated by the I-T Department.

Sometimes, despite filling out all the information correctly, you might still end up with a notice. While it could be a technical glitch, always respond to the notice and get a professional to check the notice as well.

Also Read: Banks Cannot Charge You For These ATM Transactions: RBI Rules You Need to Know!

(Edited by Gayatri Mishra)

Like this story? Or have something to share?

Write to us: [email protected]

Connect with us on Facebook and Twitter.

This story made me

- 97

- 121

- 89

- 167

Tell Us More

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.