There was some good news for the startup ecosystem in this year’s Budget. Last year, startups took a real beating with the inefficient rollout of the goods and services tax (GST), a return of the angel tax bogey and demonetisation, even though some ventures benefited immensely. While some major concerns remain unaddressed, there was some cause for cheer.

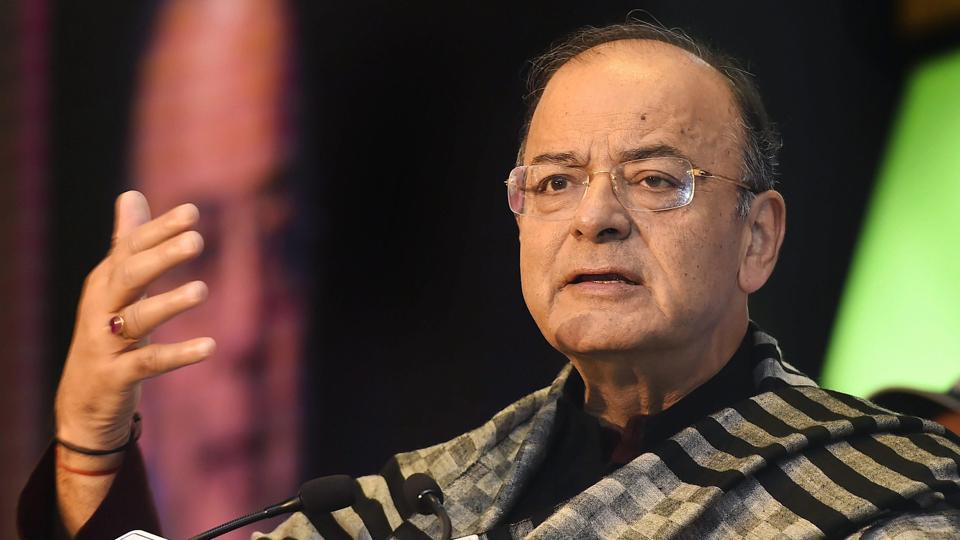

“To invest in research, training and skilling in robotics, artificial intelligence, digital manufacturing, big data analysis, quantum communication and internet of things, Department of Science & Technology will launch a Mission on Cyber-Physical Systems to support the establishment of centres of excellence. I have doubled the allocation on Digital India programme to Rs 3073 crore in 2018-19,” Jaitley said during his Budget speech.

In what form will the government allocate this fund?

Will it take the form of a grant for startups invested in solving critical technological concerns? The modalities aren’t still very clear, but if the government does decide to act along those lines, it could be of great benefit for startups. Delving a little further into the document, it is apparent that startup ventures can take advantage of other announcements as well.

One of the major announcements that should interest startups is the allocation of Rs 8,000 crore to set up broadband services across 1.5 lakh gram panchayats under the second phase of its Bharat Net project. By March 2019, the project seeks to connect 2.5 lakh gram panchayats. During his speech, Jaitley claimed that the government has already completed the first phase of this project connecting 1 lakh gram panchayats. “The government also proposed to set up 5 lakh wi-fi hotspots which will provide broadband access to 5 crore rural citizens,” Jaitley added.

For startups, this seems like a real opportunity to develop services for a whole host of rural businesses, especially those in the agriculture sector. They can further augment government services on this platform by developing digital content in the local vernacular, besides working with major telecom players to strengthen connectivity in rural India. With the government allocating a further Rs 500 crore for the development of indigenous 5G technology, certain experts contend that startups can leverage it for their benefit, although figuring out the modalities remain a concern.

Another potential space where startups can make a mark is the infrastructure sector, which has received an allocation of Rs 6 lakh crore. With the proposal for installing cashless modes of payment at toll booths, and every vehicle having an inbuilt RFID tag, this is an area of real opportunity, especially for fintech companies. These ventures can participate in developing the underlying architecture for payments at these toll booths.

Finance Minister Arun Jaitley also spoke of how invested the government is in developing artificial intelligence, although it is a little late to the party.

“Technologies such as machine learning, artificial intelligence and others are the technologies of the future, and NITI Aayog will establish a national programme to conduct research and development in these areas,” Jaitley said.

Even in the education sector, the government has sought to further digital intensity, especially with the launch of ‘DIKSHA’, a government portal dedicated to moving Indian classrooms from the “blackboard” to “digital board.”

The government’s proposal to augment the flow of foreign investments into startups through hybrid instruments like convertible bonds, preferred stocks, equity swaps and structured notes, among others, also offers hope. “The government will evolve a separate policy for the hybrid instruments,” Jaitley said.

However, once again the modalities of this proposal are yet to be worked out, and more pertinently, the Budget fails to address some of their fundamental concerns.

1) Tax holiday

When the government announced an exemption on income tax (on their profits) and capital gains tax for the first three years from the year of incorporation, it was seen as a real boost. The reality, however, is that very few startups are able of avail of this benefit primarily because they don’t break even during this period, and thus have little to no tax liability.

Many have suggested that the government should impose the three-year tax holiday only from their first year of profitability. Unfortunately, the Budget remains firm on government policy. Only those startups or “eligible businesses” (definition still unclear) which are “incorporated on or after the 1st day of April 2016 but before the 1st day of April 2019” are eligible for exemption, as per the Finance Bill.

2) ‘Draconian’ angel tax

In June 2016, the Government of India got rid of the draconian ‘angel tax’ that was imposed on start-ups in 2012. As per its notification, the government amended a provision of the Income Tax Act, “whereby capital raised by start-ups from domestic angel investors will not be taxed as income even if the investment exceeds the fair market value of the start-up’s shares,” reported Mint. Earlier, the rate of this tax was at a massive 30.9%.

However, only those startups that fulfil certain criteria set by the government remain exempt, and a lot is left at the discretion of income tax officials. Startups argue that there is a lack of clarity on the requirements for this certification from the government.

“Startups are getting harassed by Income Tax Department for raising capital, and they are threatening to consider it as income! Very bad scene and many are angry and upset,” tweeted Mohandas Pai, a major player in the Indian startup scene, on December 19, 2017.

Both founders and venture capitalists believe that this practice is extremely counterproductive, and instead, the state should further incentivise angel investors and entrepreneurs instead of penalising them. In fact, one founder started a Change.org petition to raise awareness about it. The Budget did very little to assuage these concerns.

3) GST-related concerns

A fundamental issue many had with the implementation of the goods and services tax is the lack of clarity in its rollout. With the startup scene spread across different sectors of the economy, each has their separate issues. One common concern is the amount of paperwork they need to file (both quarterly and monthly returns), resulting in unnecessary documentation costs. What startups are looking for is a simpler regulatory mechanism, which they can better comply with and relief on import duty of certain critical equipment. Once again, the Budget failed to assuage these concerns, besides not offering any sort of tax holiday.

Read also: Budget 2018: Bengaluru, Mumbai Get Major Upgrades in Railways Section

4) Lack of clarity on Startups that qualify for government funding and simpler regulation

Experts argue that there is a lack of clarity in determining which startups qualify for funding from the government. Although it has recognised over 6800 startups under its Startup India initiative, only 75 are currently receiving funding, and very few remain aware of the potential benefits of the government’s initiatives. Some have complained of the long-winded process involved in applying for government funding, while others argue that promised benefits of tax exemptions and the process of nurturing entrepreneurs (incubation) are yet to bear fruit. No further clarity on this subject was forthcoming.

Read also: Budget 2018 Unveils Rs 14 Trillion Worth of Initiatives To Boost Rural Economy

They also argue that the government’s framework for incentivising research and development among new entrepreneurs across different sectors has not evolved with the times. “The current R&D and regulatory framework was built in the ‘bio’ era to support clinical testing and research. Today, startups invest in research on software product development for which they are unable to claim any benefit. There is no mechanism to file a patent for software,” says Sanjay Vijayakumar, founder, Startup Village, an incubator based in Kochi, to the Times of India.

The answer, they believe, lies in more clarity about the regulatory framework and the licensing process for a startup across different sectors, besides provisions for single window clearance. All these factors add to the ease of doing business in India.

Like this story? Or have something to share? Write to us: contact@thebetterindia.com, or connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

We bring stories straight from the heart of India, to inspire millions and create a wave of impact. Our positive movement is growing bigger everyday, and we would love for you to join it.

Please contribute whatever you can, every little penny helps our team in bringing you more stories that support dreams and spread hope.