The contentious issue of service charges is all set to get hotter. As per new considerations by the Govt, if restaurant and hotels cannot furnish documents that show how service charges are distributed to their staff, the amount will be taxed as a part of the total income.

On Tuesday, Union minister of consumer affairs, Ram Vilas Paswan, announced the new steps that the government will take in a series of tweets on Tuesday night.

“In view of seriousness of issue, Dept. of Consumer Affairs has written to CBDT [the Central Board of Direct Taxes] to consider inclusion of Service Charge while assessing Tax,” he wrote.

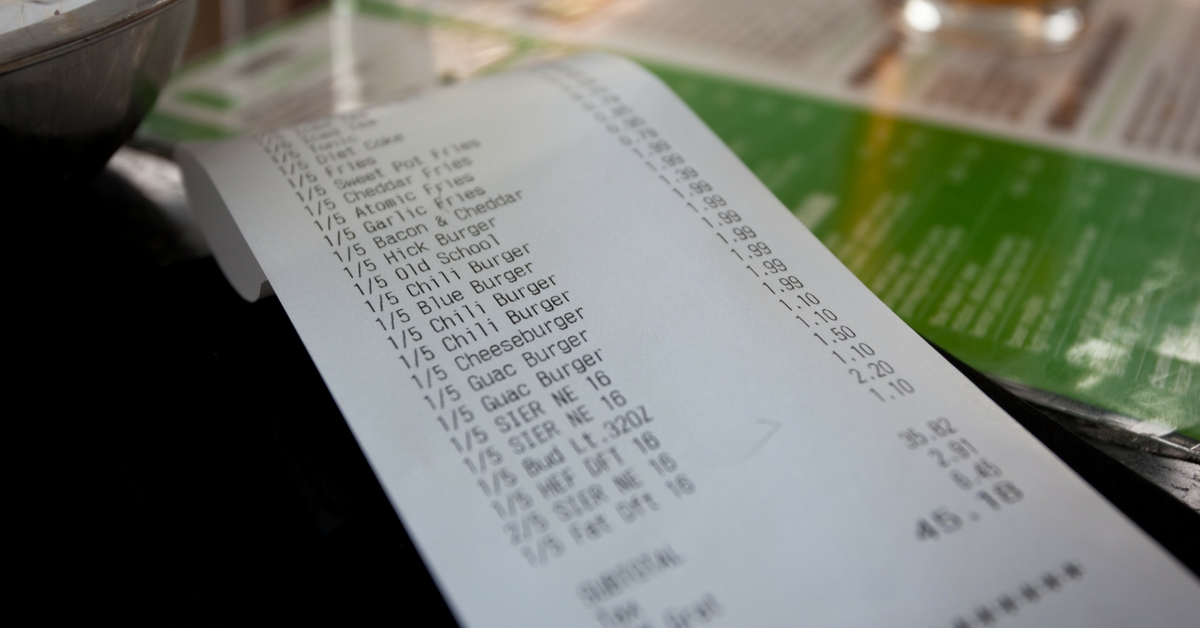

After releasing a set of guidelines in April, the Centre said it isn’t mandatory for customers to pay service charges on hotel and restaurant bills.

As per these guidelines, the column of service charge in a bill will be blank for customers to fill up before making the final payment.

Why? Well, one of the clauses state that placing an order is done after the customer agrees to pay the price on the menu along with the applicable taxes.

Charging anything above this, without the prior consent of the customer would amount to unfair trade practices under the Consumer Protection Act 1986.

The Consumer Protection Act, 1986 provides that a trade practice which, for the purpose of promoting the sale, use or the supply of any goods or for the provision of any service, adopts any unfair method or deceptive practice, is to be treated as an unfair trade practice and that a consumer can make a complaint to the appropriate consumer forum established under the Act against such unfair trade practices.

If a restaurant still insists on charging a service charge then consumers can file a complaint in Consumer Court.

Restaurant associations, unsurprisingly, were not happy with the move when it was announced, saying these guidelines were not laws, and therefore not enforceable.

You may also like: Did You Know You Can Refuse to Pay Service Charge Added on Your Restaurant Bill?

Now the government has stated that it will tax restaurants that levy unaccounted service charges. The official added, India Times reported, that eateries collecting a service charge must prove they were distributing the collected amount to the staff.

If not, the collection should be taken into account as part of their income, the official said.

Like this story? Or have something to share?

Write to us: contact@thebetterindia.com

Connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?