Please, Mister Finance Minister: What India Hopes for in the Upcoming Union Budget

The upcoming budget will be crucial in determining consumption and investment patterns over the next year.

Tax cuts with a side of tech: All India wants from the Union Budget 2017-18.

On February 1, 2017, the national capital will see a man leave the North Block of the Secretariat Building at around 9 a.m., bearing a simple leather suitcase. Inside, lie documents that will affect 1.2 billion Indians over the next financial year.

Finance Minister Arun Jaitley will, wittingly or not, make history in the coming days as his ministry rolls out the 2017-18 Union Budget. The exercise is one that is bound by code and laced with convention, but if the last few months are any indicator at all, the current government is not one to jitterbug with tradition.

For starters, Jaitley’s team must consolidate a statement of the estimated receipts and expenditure of the government for the approaching financial year an entire month before it is usually presented. Furthermore, the Railway Budget — a behemoth of a task, standalone by any measure — will be incorporated into the General Budget this year.

While both these departures from routine comprise hot points of conversation in financial tabloids and forums, what is being most debated upon are the effects that the Modi government’s demonetisation drive will have on economic climate over the next year. It goes without saying that any budget worth its salt must accommodate this.

Halwa, Hedges and Hullabaloo

The famous halwa ceremony, where it is customary for the finance minister to serve halwa to his team, marks the beginning of the printing of budget documents in the basement of Delhi’s North Block. After the function, around a 100 officials are sequestered with limited contact with the outside world, until the Budget Speech is made.

A generous dollop of sugary semolina might be just what the doctor ordered, if the January 6 announcement by the Central Statistics Office (CSO) is anything to go by. Earlier this month, the CSO released its official forecast for GDP growth this financial year, predicting a 7.1% growth rate, an estimate that critics fear is too optimistic even though the number is down from 7.6% in 2015-16. (For reference, Goldman Sachs predicted 7.9%, CARE 7.8%, and Deutsche Bank 7.5%, before revising these figures to 6.8%, 7% and 6.5% respectively, post-demonetisation.)

Previously reliable indices (such as the Manufacturing Purchasing Managers index and the Services Purchasing Managers index) fell dramatically after Modi’s November 8 announcement as well. This further complicates the process of taking the temperature of the economy in lieu of the budget, as the uncertainty about the effects of demonetisation send the country’s financial gurus into a feverish frenzy.

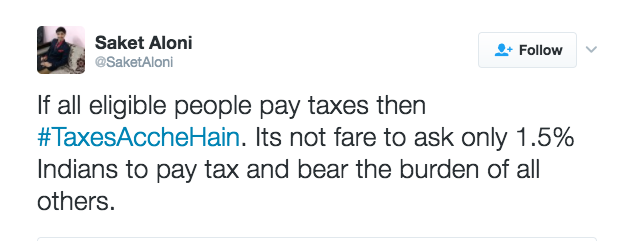

#TaxesAccheHain

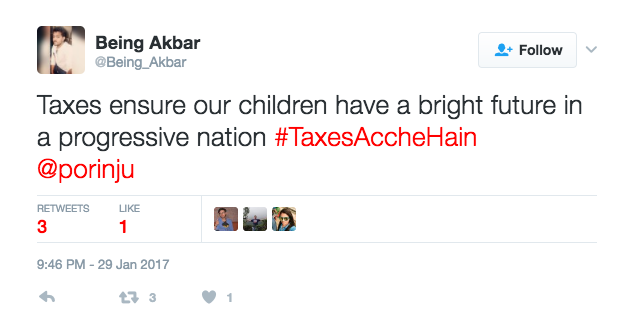

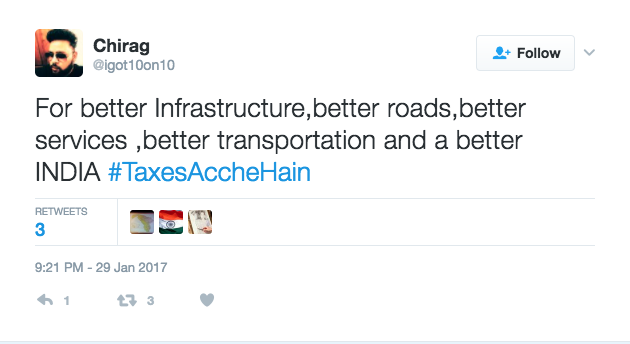

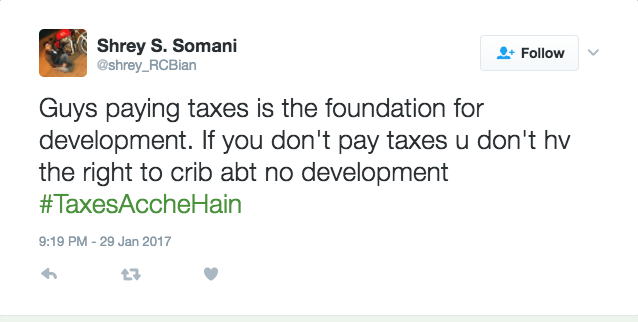

Despite the media maelstrom brewing in the lead-up to the budget announcement, Twitter indicates that a fair number of Indians are choosing this time to reaffirm their faith in the democratic system. Using the hashtag #TaxesAccheHain, several have taken to social media with a haters-gonna-hate attitude, announcing their optimism for the budget.

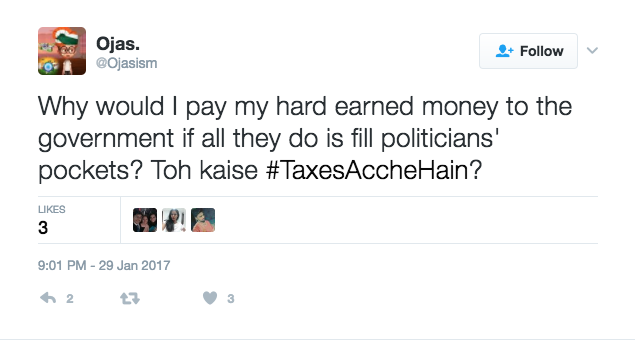

Others have been more cynical, calling for greater transparency and a more bourgeois budget.

However, as far as gauging public opinion goes, it seems that the most value can be derived from that smattering of engaged citizenry who have taken to addressing specific issues under the ambit of the budget. Universally, these vocalise hopes for a revamped proposal that is kinder to the common man, offering tax concessions that will boost recovery after the shock the economy faced due to the recent cash crunch.

An analysis of all India wants for 2017 reveals populist trends.

Income Tax:

Possibly the most discussed aspect of Jaitley’s upcoming proposal is the possibility of a change in Income Tax slabs. A revision is likely to increase the minimum taxable amount per annum, a move that will be welcomed by salaried employees across the board.

In fact, PMK leader S Ramadoss even issued a formal statement urging the Centre to increase the income tax exemption limit for individuals from Rs 2.5 lakh to Rs 5 lakh.

Goods and Services Tax:

The latest reports indicate that the Union and state governments continue to tussle over the launch of a new national sales tax. The GST has been proposed in order to check tax evasion and improve tax compliance, and it is widely expected that the budget will finally describe some version of it. This will be good news for businesses and will enable them to file taxes more easily.

Corporate Tax:

Businesses are hoping for the corporate tax rate (35% at present) to be reduced to below 20%, with further elimination of exemptions.

“In the budget, it is important to bring down the individual tax and corporate tax rates so that money is there in hands of people for consumption and investment,” Sunil Kanoria, President of Assocham, said in an interview with BTVi.

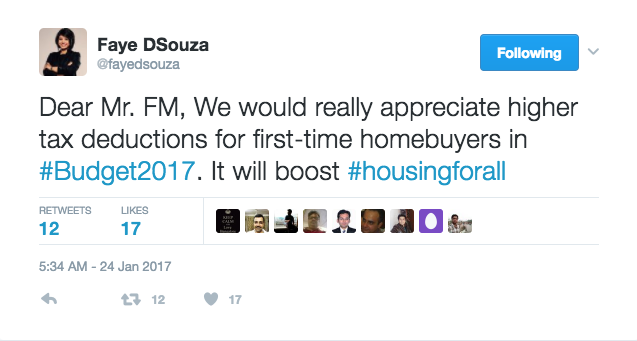

Housing:

Job creation has been a declared priority with the NaMo government and as such low-cost housing and tax cuts, especially for new homebuyers, could give many respite in the current economic climate. Tax cuts for those involved in the construction of affordable housing will be an added incentive.

Agriculture:

Perhaps no other sector of the Indian economy has faced greater struggles with cashless transactions than those employed in farming and agriculture. Besides usual incentives to assist rural farmers in the purchase of farming equipment, seeds and fertilisers, it is expected that agriculturists will be provided with better access to cashless transaction modes.

Small Businesses and Startups:

The informal sector in India is responsible for over half of the country’s economic output and employs 90% of its 470 million workforce. At present, the sector is on a downcycle and with American policy changes following the Donald Trump election, a withdrawal of foreign investment in India is expected. As such, boosts that would enable startups with access to seed funding and focused spending on initiatives like Skill India and Make in India could go a long way.

Speaking to the Indian Express at the one-year anniversary of the government programme Start-Up India, Commerce and Industry Minister Nirmala Sitharaman hinted that startups could expect some tax benefits in the upcoming Budget.

Cashless Transactions:

In keeping with the heavy marketing that has accompanied the Modi government’s drive for cashless transactions, the state is expected to invest in infrastructure to facilitate the convenient use of plastic money and digital wallets.

Railways:

With the inclusion of the Rail Budget in the General Budget, much discussion has surrounded what the specifics of this budget might be. Many hope for passenger fares to be reduced, at least for those seats that come under the non-A/C category. Investment in new trains and better rail infrastructure is also expected.

***

A Plebeian Plea

The Centre for Budget and Governance Accountability (CBGA) is an independent, non-profit organisation that works to enhance transparency and accountability in governance through a rigorous analysis of government policies and budgets. It’s primary aim is to bridge the gap between the elected and the electorate, fostering people’s participation in public policy processes by uncluttering them from the jargon of the technical.

Every year, the organisation collates data from experts as well as civil society organisations that work for development on the ground, to present a Charter of Demands from the Union Budget to the government. This is a publication that presents suggestions for policies across sectors, particularly those areas that directly impact the underprivileged and underrepresented in Indian society.

The 2017-18 submission calls for greater transparency in the publication of budget documents, financial support for the National Health Mission, investments in Gender Responsive Budgeting, the plugging of loopholes in international taxation and an addressal of the dearth of workers and funds thus far allotted to tribal development, among other things.

Following the release of the Budget, the CGBA also publishes an Analysis of the Union Budget every year, analysing the government’s focus on issues like education, healthcare, women and child policies, food security, the urban poor, agriculture and climate change, among others.

India is a price-sensitive market, grappling with the aftershocks of extremely bold economic policy. Undoubtedly, the 2017-18 budget will be a challenging one to draft, but many believe it will be one that supplements, even compensates for, the nerve of the government’s previous financial decisions, with equal rigour. The upcoming budget will be crucial in determining consumption and investment patterns over the next year, both sizeable indicators of a growing economic power.

Finance Minister Arun Jaitley has already doled out the halwa; many hope to taste the sweetness of Acche Din ahead.

***

What are you looking forward to about the Union Budget? Tweet your thoughts using #Budget2017 and tag @TheBetterIndia

Like this story? Or have something to share? Write to us: [email protected], or connect with us on Facebook and Twitter.

NEW: Click here to get positive news on WhatsApp!

If you found our stories insightful, informative, or even just enjoyable, we invite you to consider making a voluntary payment to support the work we do at The Better India. Your contribution helps us continue producing quality content that educates, inspires, and drives positive change.

Choose one of the payment options below for your contribution-

By paying for the stories you value, you directly contribute to sustaining our efforts focused on making a difference in the world. Together, let's ensure that impactful stories continue to be told and shared, enriching lives and communities alike.

Thank you for your support. Here are some frequently asked questions you might find helpful to know why you are contributing?

This story made me

-

97

-

121

-

89

-

167